The Detailed Guidance for China Company ‘s

(Elite Stage’s gift: 83 pages of electronic document “The Impact of the War in Ukraine on Global Trade and Investment” is available for free

Optimal & Legal: 5 ways to Do Overseas

(Elite Stage’s gift: 56 pages of electronic document “Anticipating Inflation in Asia 2022 & Beyond” is available for free within a limited time!

Successful Cases: the Key Points When Applying for

On April 26 this year, Singapore’s entry measures were further simplified. No matter whether you are holding a short-term visa

SG PR Application in the Relaxation Stage: seize

“Applying for PR” has always been one of the hot topics that foreigners in Singapore are most concerned about.

China Q1 2022 Economic Data Overview– Key

According to the recently released economic statistics by the National Bureau of Statistics and the Ministry of Commerce, China’s first quarter (Q1)

Singapore: New Points System for EP Applicants

Singapore Singapore will introduce a new points system for Employment Pass (EP) applicants from 2023, in addition to higher qualifying salary

Why Entrepreneurs Are Choosing to Do Business in

We once lived in a world where few countries enjoyed economic prosperity while the majority of countries watched with

Shanghai Grocery Purchase Guidance Summary+Aid

Since the epidemic control in Shanghai in April 2022, grocery purchase has become a top priority for many citizens. Elite Stage

How Do Smallest Businesses Survive Omicron

Beijing has rolled out tax relief and other beneficial policies such as more favourable loan rates and rent exemptions, rather

New Relief Measures for Service Industry

The service industry and small businesses in China will benefit from a series of new relief measures ranging from

Update of the Boarding Requirements for the United

From April 1st, for the direct flights from the United States to China, the original report of the antigen test

Hong Kong Budget 2022-23: All You Need to Know

Hong Kong 2022-23 Budget (2022-23 Budget) announces pending plans worth over HK$170 billion to boost the economy and maintain public confidence.

China Will Provide 2.5 Trillion for Tax Rebate and

The fifth session of the 13th National Committee of CPPCC had it closing ceremony at the Great Hall on March

200,000+ Foreigners To Get Better Support When

Nearly a quarter of overseas nationals working in China are based in Shanghai, at 215,000 people, the highest proportion in the country, according to

Newly Established Foreign-Invested Companies

According to China’s Ministry of Commerce, the number of foreign-invested companies newly established in China in the first 11 months of 2021 was 43,370, rising

China Annual Individual Income Tax Declaration

Annual Individual Income Tax declaration will start on March 1st. Q1 Who ? Resident individual whose Tax withheld is

A Guide to Minimum Wages in China in 2022

CHINA Minimum wages continue to rise. Starting in 2022, Shenzhen and Henan raised their minimum wage standards from January 1, while Chongqing and

China’s Small Business Tax Incentives in 2022

In this article, we introduce the major tax incentives for small businesses, including corporate income tax (CIT) cuts for small and low-profit

Get Ready! 2022 HK Company Audit Peak is coming!

HONG KONG Every year, Hong Kong Companies shall complete the profit tax return and submit it to Inland Revenue

US-China Travel Fast-Track Program to Start in

The American Chamber of Commerce in China said that a US-China travel fast-track program, which allows for US business people and

The Highlights of 2022 Lin-gang FTZ Innovation

Lin-gang Special Area At the beginning of New Year 2022, as the business investment agency, Elite Stage was invited

Negative List for Market Access to Be Further

Negative List China will continue to shorten the negative list for market access this year, as part of the

China Lowers Tariffs on 954 Products from January

the Customs Tariff Commission of the State Council (‘the commission’) will adjust import and export tariffs on selected goods in 2022

Trading Companies, Check out the Export Tax Refund

To encourage exports, the Chinese government formulated and implemented a series of policies of which the export tax rebate is one

How to Prepare for an Effective Annual Audit in

Whether an audit is effective or not makes a big difference in a company’s governance and development in the long run,

China’s Medical Devices: Industry Key Market Entry

China healthcare industry is currently ranked the second largest in the world behind the US. The market has grown at a consistently

5 Things to Avoid HK Company Bank Account Frozen

Whether you are going to open your very first bank account for your Hong Kong company or you have luckily opened

How to Do With Work Permit if Changing the Job in

If a foreigner working in China changes his employer, he shall first cancel his existing work permit. After cancelling the original

China’s Tax Incentives: An Overview of Key

China’s tax incentives are preferential tax policies offered by its local and/or central governments to incentivize or encourage a

Attention! Hong Kong Has Tigntened the Registry

The government has tightened registry searches in Company Registry and Land Registry – people will have to provide their name

China’s New Tax Deferment Measures and

Tax deferment measures for manufacturers, individual businesses, unincorporated firms. According to the executive meeting, the following taxes for

The Analysis of Minimum Wages in China in 2021

Minimum wages in China continue to grow. So far, in 2021, the provinces of Heilongjiang, Hubei, Jiangsu, Jiangxi, Ningxia,

How to Open a Bank Account for Foreign Companies

Setting up a company in China’s appealing market may be subject to varied requirements, depending much on the business entity chosen

Income Tax Rate of These 3 Places in Mainland is

Have you got the news that at the end of this year, the previous taxation policy of eight tax

By Early 2022, Borders Might Open If Vaccination

China may open its borders after it vaccinates over 85 percent of its population by early 2022, said Gao Fu,

Social Insurance Exemptions for Expats in China

According to the requirement of The Ministry of Human Resources and Social Security,foreign employees are required to participate

Mutual Visa Exemption: People Can Enter China

The official website of the National Immigration Administration replied that those who are currently covered by the mutual visa exemption can

Family Members Can Apply PU Letter Based in

Recently, the Chinese Government implemented heightened application requirements for non-Chinese nationals seeking to obtain Official Invitation (“PU”) Letters sponsored

Long Term Working in China, How to Deal With

Hi, guys In the previous topic on personal income tax in China, we discussed Kevin’s case as the example

How to Do Authentication Abroad for Business Use

With the development of global economy, China becomes one of the most popular place of foreign investments. When overseas

Officially Released: The 2021 Shanghai Foreign

The 2021 Shanghai Foreign Investment Guide (hereinafter referred to as the 2021 Investment Guide), which is compiled by

New Signal: Shanghai May Adopt Green Card Benefits

Have you heard that in the future, Shanghai Pudong District will implement the recommendation mechanism of Foreigner’s Permanent

Green Card Trend: Tips for Reunion of Husband and

Affected by the global epidemic, China’s entry and exit management has become more stringent. Many foreigners have been

Hong Kong & Shanghai– Expand

Several memorandums, an agreement and a letter of intent are inked between Hong Kong and Shanghai during the

Tax-Exempt Fringe Benefits for Expats to Expire

Starting next year, foreigners working in China may no longer be entitled to some tax-free fringe benefits (for

Pudong New Area Issued Fresh Guidelines for

The Pudong New Area in eastern Shanghai recently issued a new set of guidelines widely seen as a blueprint

More Taxpayers to Benefit from Uncredited VAT

On April 28, 2021, China’s Ministry of Finance (MOF) and State Taxation Administration (STA) released the Announcement on Clarifying

How to Comply with Hong Kong Accounting Standards?

As a Hong Kong business entity, your company must prepare audited financial statements on an annual basis. Please make

Comfirmed!The Passport Application&Renewals

Affected by the Covid-19 pandemic with more dangerous Delta variant virus, China has stopped issuing and renewing passports

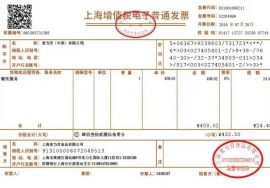

China’s E-Fapiao System at a Glance

Over the last few months, China has been quickly expanding the pilot program on electronic special value-added tax