Hong Kong Budget 2022-23: All You Need to Know

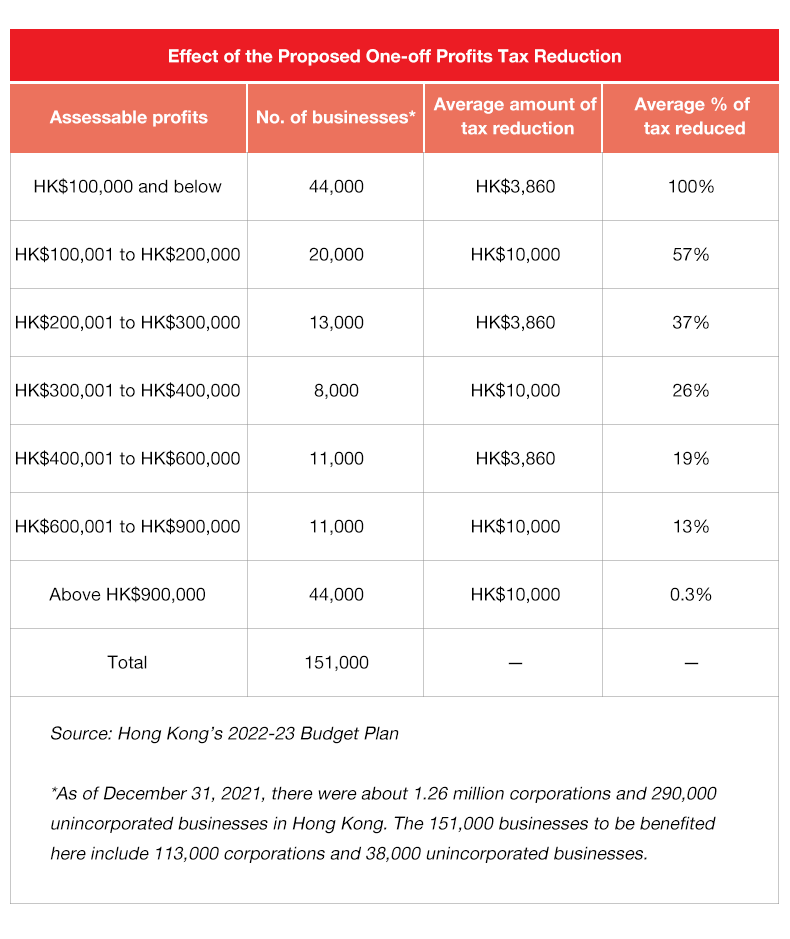

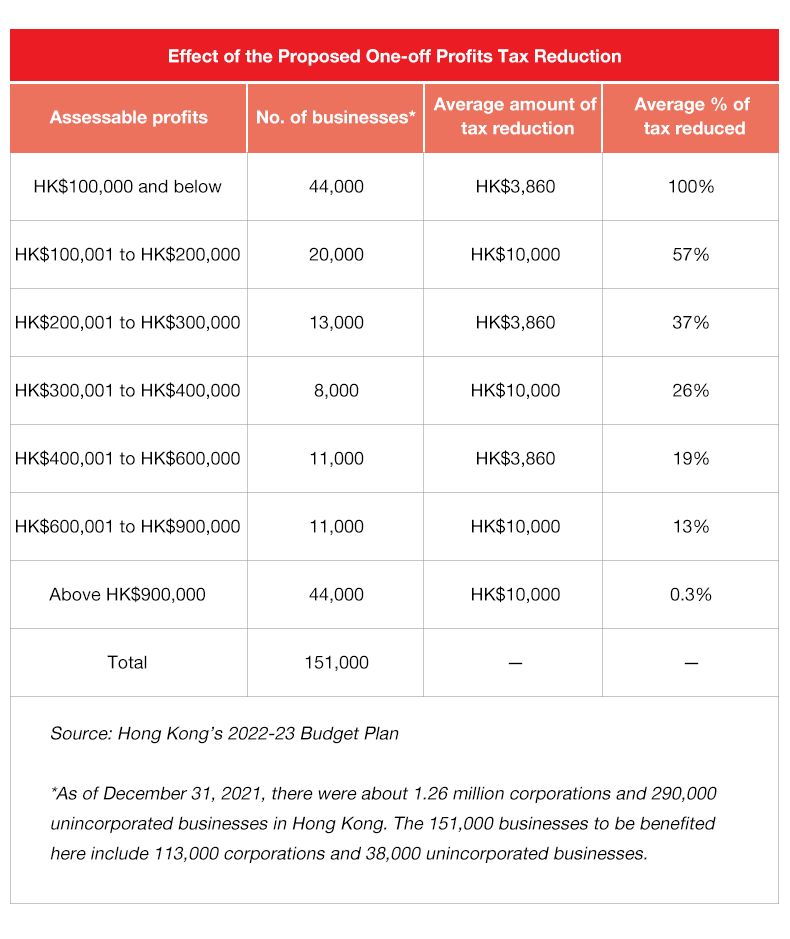

Taxpayers should file their profits tax returns and tax returns for individuals for the year of assessment 2021/22 as usual.

Before the enactment of the relevant legislation, taxpayers should file their profits tax returns for the year of assessment 2021-22 as usual.

The proposed tax reduction will only be applicable to the final tax for the year of assessment 2021/22, but not to the provisional tax of the same year. Therefore, taxpayers are still required to pay their provisional tax on time despite the proposed reduction measure.

No application is required. The IRD will directly send refund cheques to eligible businesses for the business registration fees paid in respect of the Waiver Period. The refund arrangement will be announced after the relevant legislative amendment is passed by the LegCo.

Extending the waivers/concessions of the existing 34 groups of government fees and charges for 12 months starting from October this year. This measure will benefit a wide range of sectors, such as aviation, maritime, logistics, retail, catering, agriculture and fisheries, construction, tourism, and entertainment.

Continuing to grant the 75 percent rental or fee concession currently applicable to eligible tenants of government premises and eligible short‑term tenancies and waivers under the Lands Department for six months until September 30, 2022. During the period, tenants who have to close their properties at the request of the Government will continue to receive full rental waiver for the duration of the closure.