China 2025 Action Plan for Stabilizing Foreign

Foreign investment is crucial for promoting high-level opening-up. It plays an important role in fostering new quality productive forces

CRS Global Tax Transparency : Key Information You

With the push of economic globalization, cross-border financial activities are becoming increasingly frequent. Whether businesses are expanding overseas or

Singapore Goods Import/Export Process, Taxes, and

As one of Asia’s most resilient economies, Singapore maintains a stable and positive growth trend. In 2024, Singapore’s total

Singapore: Business Upgrades with Salary Subsidies

In recent years, the Singapore government has continuously increased support for businesses and employee skills development, especially through the

Hong Kong’s Patent Box Regime and Effects

Background On July 5, 2024, the Hong Kong SAR Government gazetted the Inland Revenue (Amendment) (Tax Concessions for Intellectual

The Highlights of 2022 Lin-gang FTZ Innovation

Lin-gang Special Area At the beginning of New Year 2022, as the business investment agency, Elite Stage was invited

Negative List for Market Access to Be Further

Negative List China will continue to shorten the negative list for market access this year, as part of the

China Lowers Tariffs on 954 Products from January

the Customs Tariff Commission of the State Council (‘the commission’) will adjust import and export tariffs on selected goods in 2022

Trading Companies, Check out the Export Tax Refund

To encourage exports, the Chinese government formulated and implemented a series of policies of which the export tax rebate is one

How to Prepare for an Effective Annual Audit in

Whether an audit is effective or not makes a big difference in a company’s governance and development in the long run,

China’s Medical Devices: Industry Key Market Entry

China healthcare industry is currently ranked the second largest in the world behind the US. The market has grown at a consistently

5 Things to Avoid HK Company Bank Account Frozen

Whether you are going to open your very first bank account for your Hong Kong company or you have luckily opened

How to Do With Work Permit if Changing the Job in

If a foreigner working in China changes his employer, he shall first cancel his existing work permit. After cancelling the original

China’s Tax Incentives: An Overview of Key

China’s tax incentives are preferential tax policies offered by its local and/or central governments to incentivize or encourage a

Attention! Hong Kong Has Tigntened the Registry

The government has tightened registry searches in Company Registry and Land Registry – people will have to provide their name

China’s New Tax Deferment Measures and

Tax deferment measures for manufacturers, individual businesses, unincorporated firms. According to the executive meeting, the following taxes for

The Analysis of Minimum Wages in China in 2021

Minimum wages in China continue to grow. So far, in 2021, the provinces of Heilongjiang, Hubei, Jiangsu, Jiangxi, Ningxia,

How to Open a Bank Account for Foreign Companies

Setting up a company in China’s appealing market may be subject to varied requirements, depending much on the business entity chosen

Income Tax Rate of These 3 Places in Mainland is

Have you got the news that at the end of this year, the previous taxation policy of eight tax

By Early 2022, Borders Might Open If Vaccination

China may open its borders after it vaccinates over 85 percent of its population by early 2022, said Gao Fu,

Social Insurance Exemptions for Expats in China

According to the requirement of The Ministry of Human Resources and Social Security,foreign employees are required to participate

Mutual Visa Exemption: People Can Enter China

The official website of the National Immigration Administration replied that those who are currently covered by the mutual visa exemption can

Family Members Can Apply PU Letter Based in

Recently, the Chinese Government implemented heightened application requirements for non-Chinese nationals seeking to obtain Official Invitation (“PU”) Letters sponsored

Long Term Working in China, How to Deal With

Hi, guys In the previous topic on personal income tax in China, we discussed Kevin’s case as the example

How to Do Authentication Abroad for Business Use

With the development of global economy, China becomes one of the most popular place of foreign investments. When overseas

Officially Released: The 2021 Shanghai Foreign

The 2021 Shanghai Foreign Investment Guide (hereinafter referred to as the 2021 Investment Guide), which is compiled by

New Signal: Shanghai May Adopt Green Card Benefits

Have you heard that in the future, Shanghai Pudong District will implement the recommendation mechanism of Foreigner’s Permanent

Green Card Trend: Tips for Reunion of Husband and

Affected by the global epidemic, China’s entry and exit management has become more stringent. Many foreigners have been

Hong Kong & Shanghai– Expand

Several memorandums, an agreement and a letter of intent are inked between Hong Kong and Shanghai during the

Tax-Exempt Fringe Benefits for Expats to Expire

Starting next year, foreigners working in China may no longer be entitled to some tax-free fringe benefits (for

Pudong New Area Issued Fresh Guidelines for

The Pudong New Area in eastern Shanghai recently issued a new set of guidelines widely seen as a blueprint

More Taxpayers to Benefit from Uncredited VAT

On April 28, 2021, China’s Ministry of Finance (MOF) and State Taxation Administration (STA) released the Announcement on Clarifying

How to Comply with Hong Kong Accounting Standards?

As a Hong Kong business entity, your company must prepare audited financial statements on an annual basis. Please make

Comfirmed!The Passport Application&Renewals

Affected by the Covid-19 pandemic with more dangerous Delta variant virus, China has stopped issuing and renewing passports

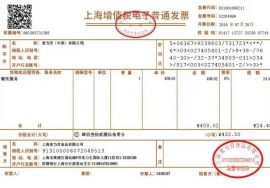

China’s E-Fapiao System at a Glance

Over the last few months, China has been quickly expanding the pilot program on electronic special value-added tax

Speech Sharing: Tax Issues after Foreigners

At the beginning of June, Elitestage invited tax expert Eve Yu to share a speech on the personal income tax

With This Tool, 3 Minutes Nail the Company Names?!

With the continuous development of the economy, more and more foreigners want to start their own business in China. It’s also

How to Set Up an Offshore Company for 2021: 4

Due to the epidemic, many clients are faced with a problem that they cannot choose which place is more suitable for them to set up an

Applying for Chinese Visa, Is the PU Letter Still

During the epidemic period, China’s temporary visa policy is updated from time to time. Is the PU letter still the key point

Doit connaître cet endroit si vous êtes à l'étranger

Peu importe que vous soyez un étudiant étranger ou un étudiant diplômé, si vous vivez en Chine, il y a un endroit que vous devez savoir - Shanghai Lingang FTZ. Lingang FTZ essaie de devenir un pôle de talents en proposant des politiques de soutien préférentielles pour les talents internationaux. Certains d'entre eux

Apprenez à connaître les avantages du général

Les assujettis à la TVA en Chine sont séparés en deux catégories différentes - les contribuables généraux et les petits contribuables - et le

Plus de doutes! Questions et réponses sur la petite échelle

Comme stipulé, les contribuables à la TVA en Chine sont classés en contribuables généraux et contribuables à petite échelle en fonction du niveau de comptabilité financière et de l'échelle.

SH Lingang New Area: Prochains talents étrangers

Sans aucun doute, Shanghai est l'une des villes internationales les plus attrayantes pour les expatriés étrangers pour travailler et vivre

Comment obtenir l'exonération d'impôt sur les bénéfices offshore de Hong Kong

Hong Kong offre des avantages fiscaux tels qu'un régime fiscal simple, une opportunité de réaliser des bénéfices exonérés d'impôt et de faibles

Annulation d'une entreprise, le plus tôt sera le mieux

L'annulation d'une entreprise est en fait une étape très courante dans les opérations commerciales, mais les personnes qui l'ont vécue le savent

Comment faire une demande de visa pour la Chine?

Planning to visit China, but don’t know how to apply for a China visa? We’re breaking it down for you

Politiques spéciales de Shanghai Lingang pour les étrangers

Afin de réaliser l'objectif d'une opération pratique avec des investissements à l'étranger, l'entrée et la sortie gratuites des

Réduction du taux d'imposition des sociétés dans la nouvelle zone de Lingang de

Shanghai Municipal Finance Bureau released the Circular about Corporate Income Tax Policies for Key Industries at Lingang New Area of

Importation de masques faciaux de Chine: fournisseur,

At present, Covid-19 virus has become the most serious issue worldwide. Countires have been confronted with the rapid growth

Résumé des questions sur le visa automatique de 2 mois

Récemment, de nombreux expatriés sont venus à Elite Stage pour se renseigner sur les problèmes d'expiration ou de renouvellement de visa ou de permis de travail, certains

9 faits de base à connaître avant d'enregistrer un

Incorporation de la société de Hong Kong Aujourd'hui, de nombreux investisseurs et entrepreneurs choisissent de créer leur entreprise à l'étranger, en particulier

Les réductions d'impôts et de frais stimulent la croissance du PIB

Résumé La Chine a réduit plus de 2000 milliards de yuans (286,89 milliards de dollars) de réductions d'impôts et de taxes en 2019, soit

Dans quelle condition les étrangers doivent-ils déposer

Nous sommes ravis que l'épidémie de nouveau coronavirus soit désormais effectivement sous contrôle, de nombreuses entreprises reviennent à la

Business Opportunities for German Investors in

Germany and China established diplomatic relations almost 50 years ago and, since then, have become partners, both economically and

Q&A about Company Registration for Most

When dealing with international clients we often get questions about the term ‘legal person’and ‘supervisor’ and other key roles.