Lower Corporate Tax Rate in Lingang New Area of Shanghai FTZ

Shanghai Municipal Finance Bureau released the Circular about Corporate Income Tax Policies for Key Industries at Lingang New Area of China (Shanghai) Pilot Free Trade Zone, which will be implemented retrospectively from January 1, 2020.

The Circular clarifies a preferential corporate tax policy that was first made known at the unveiling of the overall plan of Lingang New Area Free Trade Zone (FTZ) back in August 2019.

According to the Circular, eligible enterprises engaged in the production, development, or research and development (R&D) of products within four key industries – integrated circuits (IC), artificial intelligence (AI) biomedicine, and civil aviation will be eligible for a lower corporate income tax (CIT) rate of 15 percent in the first five years since its date of establishment.We break down key points of the new preferential policy below.

Which enterprises can qualify for the preferential tax policy?

Under the new preferential policy, eligible enterprises will be subject to a CIT rate of 15 percent, reduced from the usual 25 percent that applies to businesses in China.

To be eligible, enterprises must meet the following conditions listed in the Circular:

The enterprise must be a legal entity, and registered in the Lingang New Area from January 1, 2020;

The enterprise’ main business is in the IC, AI, biomedicine, or civil aviation industries; and

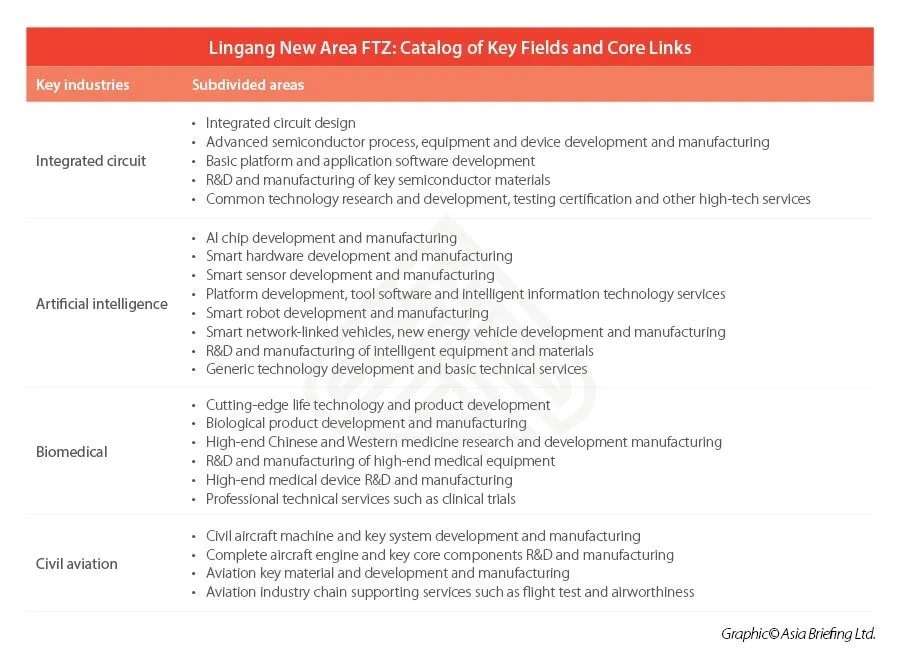

The enterprise must engage in substantive production and R&D activities in the ‘Catalog of Key Fields and Core Links’ (see table below).

In the last of these requirements, authorities define ‘substantive’ activities as the fixed and continual business engagement in one of the eligible key sectors – demonstrated either by fixed premises, staff, or supporting software and hardware that matches the production, research, or development activities.

Lingang New Area: New hub for high-tech R&D and manufacturing

Lingang New Area is a newly carved out area of Shanghai’s Pilot Free Trade Zone (FTZ), that was established just one year ago on August 6, 2019. On paper, and in practice, the plans are part of broader measures to improve the business climate for foreign investors in China.

As described by the overview plan, one of the key priorities of the FTZ is to establish a frontier of industrial clusters with key core technologies and capabilities – using preferential tax rates, customs supervision, and enhanced cross-border financial management to attract businesses in key industries within the zone.