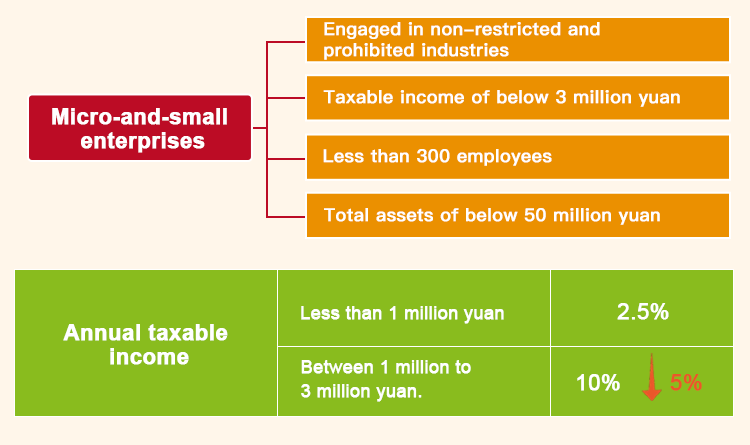

We will extend tax and fee reduction policies that support manufacturing, micro and small enterprises and self-employed individuals, and expand the scale and scope of those policies. A temporary exemption on VAT payments will be granted to small taxpayers.Compared with the current tax preference for small taxpayers:◆ The VAT levy rate for small taxpayers is reduced from 3% to 1%.◆ Monthly sales of 150,000 yuan or quarterly sales of 450,000 yuan below can enjoy the exemption of VAT.

The preference of 3% to 1% for small taxpayers will be maintained, while the VAT exemption is expected to be increased to 200,000 yuan on monthly sales or 600,000 yuan on quarterly sales.