The Registration and Licensing of Fund Managers in Singapore

Singapore has long been a popular choice as a domicile for overseas funds due to its prime location and stable political and legal environment. According to the 33rd edition of the Global Financial Centre Index released by Z/Yen Group UK in conjunction with China (Shenzhen) Comprehensive Development Institute in March 2023, Singapore is ranked third in the world.

We have been receiving inquiries from our clients regarding the establishment and licensing of funds in Singapore. In this regard, we have prepared this article with a view to providing readers with preliminary information on the registration and licensing of fund managers in Singapore.

Types of Fund Managers

According to the Guidelines on Licensing, Registration, and Conduct of Business for Fund Management Companies [SFA 04-G05] issued by the Monetary Authority of Singapore (MAS) ( Hereinafter referred to as “the Guidelines”), which refers to fund managers (FMCs):

(1) fund managers (LFMCs) holding a capital markets services (CMS) license, including venture capital fund managers (VCFMs);

or (2) fund managers licensed under the Securities and Futures (Licensing and Conduct of Business) Regulations (section 10) [“SF(10)”]. ) [“SF(LCB)R”] paragraph 5(1)(i) of the Second Schedule registered fund managers (RFMCs).

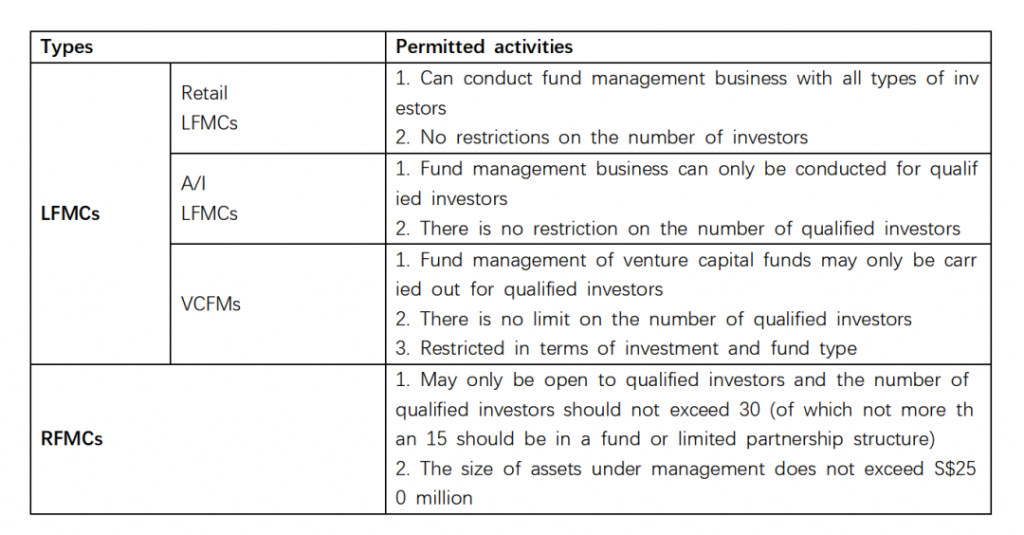

LFMCs can be further subdivided into: Retail Fund Managers (Retail LFMCs), Qualified Investor Fund Managers (A/I LFMCs), and Venture Capital Fund Managers (VCFMs) The scope of activities permitted by MAS for LFMCs, RFMCs is shown below:

Exemptions from registration and licensing of fund managers

Under the Guidelines, not any fund management activity requires registration or application for a license to be carried out and MAS will not grant a license or registration if the manager is:

merely providing a conduit or channel for clients to structure their investments or assets in the form of fund units without providing any substantial advice or influence on the merits or suitability of the investments or assets, or taking responsibility;

set up a fund structure solely to raise capitalfor the business it operates or manages, or to engage purely in the marketing and/or customer service of the fund;

manage its own assets or funds.

In addition, in response to a number of inquiries in practice, MAS has published on its website “FAQs on the Licensing and Registration of Fund Management Companies”, which provides information on applying to become a This provides guidance on the requirements and procedures for applying to become a fund administrator and appointing a representative to carry out fund management activities, including the circumstances in which exemptions may be granted.

For example, if a manager’s fund invests solely in real estate assets or securities issued by an investment holding company for the sole purpose of investing in real estate development projects and/or real estate and the fund is only available to accredit and/or institutional investors, the manager is not required to register or be licensed with MAS.

This is irrespective of the size of the company’s stake in the real estate development project, the relationship between the developer and the company, the stage of completion of the development project, and any subsequent income proceeds received after completion of the project. The exemption will not apply if the manager is also engaged in the management of financial derivatives which are “specified products” or “futures contracts” as defined in the SFA; or in the management of investments in other real estate funds and schemes.

Requirements for licensing or registration of fund managers

Prerequisites for registration and licensing

Prerequisites for registration and licensing

Substantive Fund Management Activity (Substantive Fund Management Activity) is a prerequisite for licensing or registration, i.e. MAS requires that a fund manager must carry out substantial fund management activities such as portfolio management, investment research, trade execution, etc. in Singapore.

A person who acts as an investment adviser, sub-adviser or provides research to other investment managers (in Singapore or overseas) and is able to exercise influence or control over the management of the portfolio or provide advice on the composition of the portfolio will also be considered to be carrying out substantial fund management activity. MAS will measure whether the person is able to exercise influence or control over the portfolio from the following perspectives:

(1) whether the person is involved in portfolio construction;

(2) whether the person has knowledge of or access to portfolio holdings other than publicly available information; and

(3) whether the person is identified or referred to in the fund’s prospectus, offering documents or marketing materials.

Key considerations

In assessing an application to become an RFMC, LFMC, or VCFM, MAS will consider, among other things, the following factors:

The suitability and propriety of the applicant, its shareholders, and directors.

The track record and fund management experience of the applicant and its parent or principal shareholder…

The ability to meet the minimum financial requirements set by the SFA.

The strength of internal risk management and compliance systems.

Business model/plan and projections and associated risks.

In addition, MAS requires that the fund manager should be a company registered in Singapore and have a permanent physical office in Singapore. The office should be purpose-built, secure, and accessible only to the fund manager’s directors and staff.

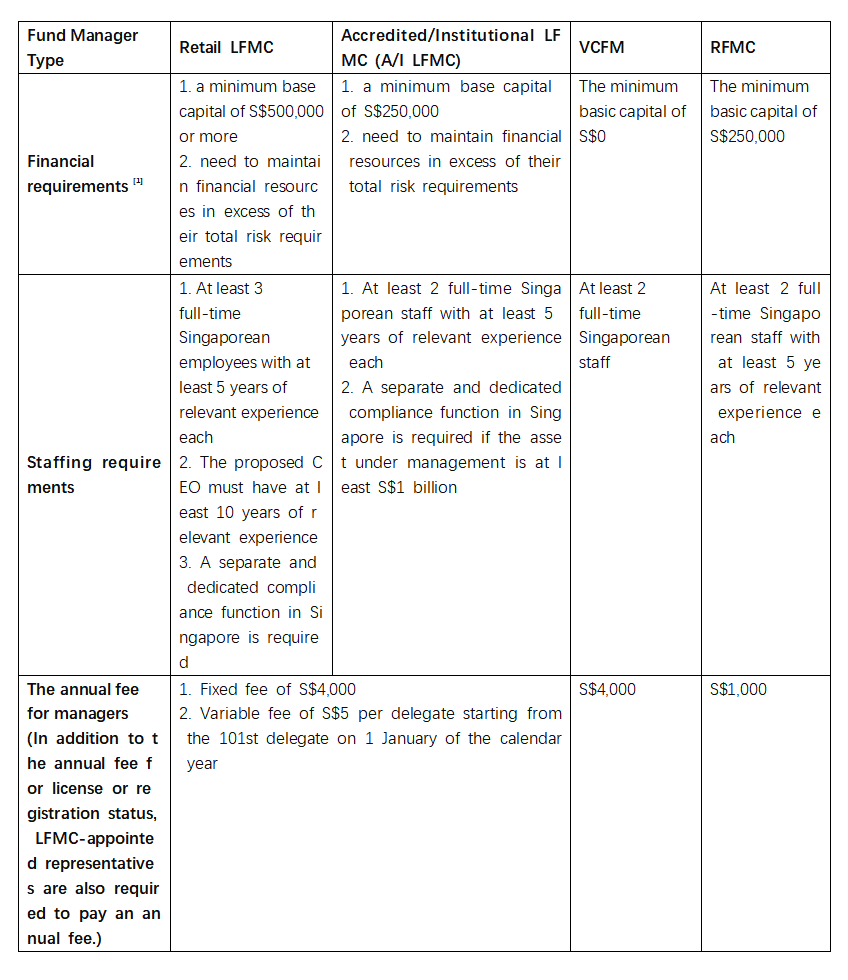

Financial and staffing requirements

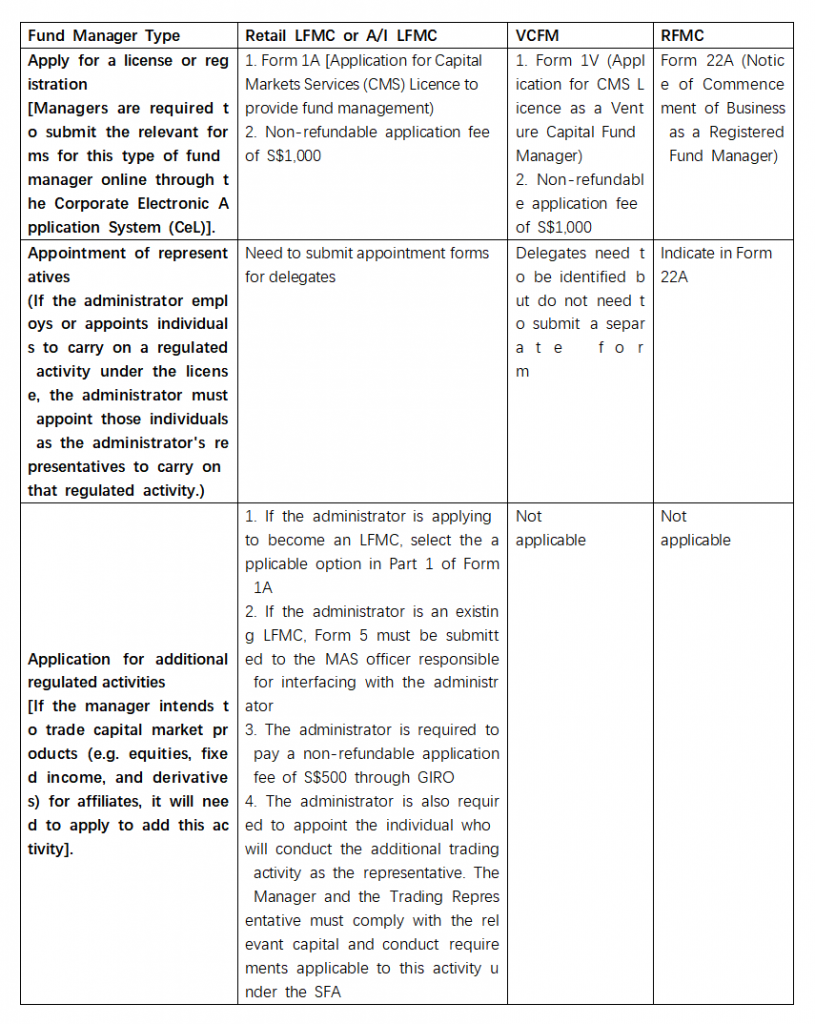

How to apply

Review Time

For LFMC and RFMC applications, MAS expects a review time of 6 months; for VCFMapplications, MAS expects a review time of 4 months. At the end of the MAS review, an approval-in-principle will be issued to the successful applicant. Applicants have up to six months to meet the requirements in the in-principle approval, which usually relate to the provision of undertakings, additional share capital, or the formal appointment of certain key personnel.

The time taken for this stage depends on how quickly the applicant can meet these requirements. Applications may undergo a longer review period if the applicant does not fully meet the relevant entry criteria, has a unique and complex business model, or has not submitted all the necessary forms, information, and documentation in the initial application.

The review period may also be extended if the applicant has made significant changes since the initial application, in which case MAS may require the applicant to resubmit.