A Guide to Filing Singapore Corporate Income Tax

Who is liable to pay Singapore Corporate Income Tax?

Companies are required to pay Singapore corporate income tax under the Income Tax Act, regardless of their tax resident status. The tax is based on any taxable income derived from carrying on business in Singapore, as well as foreign income remitted into the country.

What is the definition of a Singapore company for tax purposes, as compared to a non-tax resident, who enjoys various benefits? The following is a detailed explanation:

The business entity is registered under the laws of Singapore, Section 1967 of the Companies Act;The name of the company usually contains “Ltd” or “Pte Ltd”; A foreign company registered in Singapore, including a branch of a foreign company.

It is important to note in particular that partnerships or sole proprietorships are not subject to corporate income tax returns in Singapore.

Therefore, when both the management and control activities of a company are carried out in Singapore, the company will be deemed to be resident in Singapore for tax purposes. When making decisions on important matters, the company’s board meetings need to be held in Singapore. In addition, these companies enjoy tax relief under Singapore’s double taxation agreements with other countries.

Tax Return Deadlines

Unlike China, the start and end of the Singapore accounting year can be in any month. It usually starts from the month of incorporation and a fiscal year is completed when the company completes a natural year of incorporation. The tax filing deadline is usually 30 November of the following calendar year. In the case of 2021, for example, the deadline for filing corporate income tax returns is 30 November 2021.

Example: If the company is established on 1 January 2021, the Singapore Business Registration Authority stipulates that the first year can be a maximum of 24 months, but we generally advise our clients to put 12 months, i.e. 31 December 2021, to do their accounts once, so that they can maximize the tax benefits given by the Inland Revenue Authority of Singapore for the first 3 years (12 months is considered a tax year) of the newly incorporated company, i.e. 75% of the S$100,000 profit in the first 3 years is tax-free. This means that 75% of the first 3 years’ profits of S$100,000 will be tax-free.

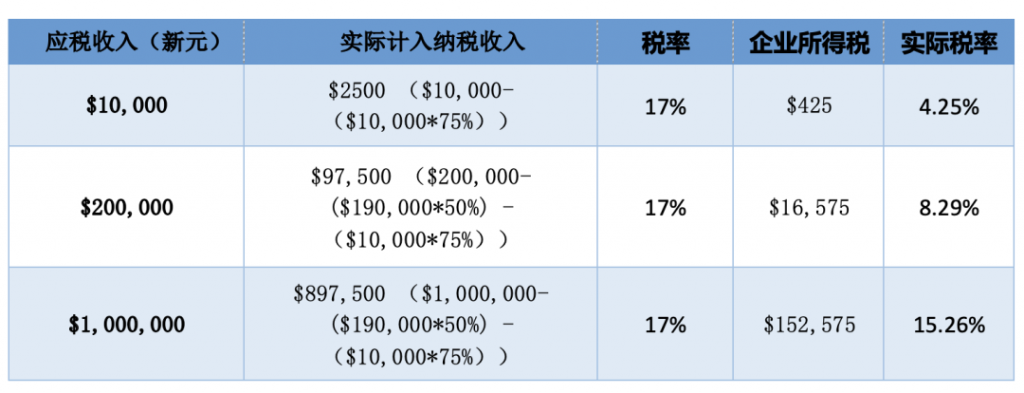

Singapore’s corporate income tax rate is 17%, but the Singapore government attaches importance to tax support for micro and small enterprises, and the effective tax rate for low-income micro and small enterprises is much lower than 17%. For example, under the latest 2020 policy, the first S$10,000 of pre-tax income is taxed at 75%, and between S$10,000 and S$200,000 of pre-tax income is taxed at 50%. Example.

The process of filing and paying Singapore Corporate Income Tax

With effect from 11 April 2021, Singapore companies will be required to file their returns through Singpass using the Government Digital Business Service (G2B). As such, all filings will be made through mytax.iras.gov.sg.

Submission of estimated taxable income (ECI) or estimated income tax forms (except in the case of exemptions)

According to the Inland Revenue Authority of Singapore (IRAS), all companies will be required to file an Estimated Chargeable Income (ECI) return from the financial year 2020 onwards.

The fiscal year in Singapore usually starts from the month of incorporation and ends when the company completes one natural year of incorporation. The deadline for filing tax returns is usually 30 November of the following calendar year.

After the end of a Singapore company’s financial year, the company is required to produce financial statements and hold a general meeting of shareholders, and all shareholders are required to sign the company’s financial statements. Usually, within one month of the AGM, the company is required to submit its financial statements to the Accounting and Corporate Regulatory Authority of Singapore (ACRA) for the annual audit filing process.

Tip: If your company is not profitable and your annual revenue is less than S$5 million, you do not need to file an estimated income tax return. ECI is only an estimated income tax return and is not a final tax return.

All companies must submit their estimated assessable income (ECI) within three months of the end of the financial year unless they meet the requirements for the ECI exemption. For example, assuming a company’s financial year end is 31 March 2023, the deadline for filing ECI for the 2024 assessment year is 30 June 2023.

Receipt of a Notice of Assessment (NOA) or Notice of Approval from the Inland Revenue Authority of Singapore (IRAS)

Upon submission of the return, the Inland Revenue Authority of Singapore (IRAS) will conduct an audit and issue a Notice of Assessment (NOA), which is a detailed report of the company’s tax liability. A company can object to an IRAS tax approval if it so wishes.

Payment of approved corporate income tax

All companies are required to pay the tax within 30 days from the date of receipt of the Notice of Assessment (NOA), unless they are eligible to pay in installments. Payment can be made by various means such as Internet banking, bank transfer, wire transfer, or cheque.

Failure to pay the corporate income tax due as scheduled will result in a 5% penalty. In addition, a penalty of 1% of the monthly unpaid tax will also accrue. In some cases, further legal or enforcement measures may be taken by the tax authorities to collect the tax arrears.

Tax Benefits and Deductions

Singapore resident companies enjoy a wider range of tax benefits and reliefs.

Tax Incentives and Deductions for Small Start-ups

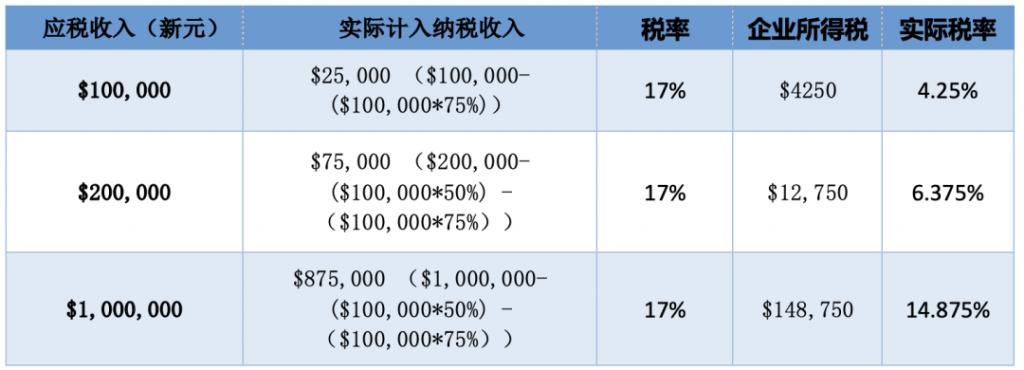

For small start-ups, the Singapore Government grants a 75% tax exemption on the first S$100,000 and a 50% tax exemption on the next S$100,000. Examples.

Any newly incorporated company that meets the following criteria is entitled to an annual tax exemption for the first three years of tax assessment of the newly incorporated company:

New Company Assessment Criteria

Established in Singapore.

Singapore’s personal income tax regime.

Up to 20 shareholders, with at least one shareholder holding at least 10% of the share capital.

A company that is not predominantly an investment holding company;

Not a company engaged in property development and sales, investment or investment and sales.

Loss Credit Front Tax Credit Scheme

To assist businesses in coping with cash flow problems arising from the economic downturn, the Government introduced in Budget 2020 an enhanced version of the Pre-Loss Credit Scheme, which allows businesses to receive a tax credit for transferring tax losses eligible for deduction in the tax year 2020 back to the previous three tax years.

This relief scheme is subject to a ceiling of S$100,000.

Double Taxation Avoidance Agreement (DTA)

A double taxation situation occurs when the foreign source income of a Singapore tax resident company is taxed overseas and the income is remitted to Singapore.

Singapore has signed more than 20 Free Trade Agreements (FTAs) and 74 comprehensive and 8 limited Double Taxation Avoidance Agreements (DTAs) to avoid double taxation situations.

Singapore tax residents who receive income from other countries can apply for a Certificate of Tax Residency (COR) from the Inland Revenue Authority of Singapore (IRAS), which is a letter certifying that the company is a tax resident in Singapore. A tax resident needs this certificate to be able to apply for the avoidance of double taxation under the Double Taxation Avoidance Agreements (DTAs) that Singapore has entered into with other jurisdictions.