What Are the Tax Types and Tax Benefits in Singapore?

That is, the effective tax rate for the first S$200,000 of taxable profits of an eligible newly registered Singapore company is 6.375%!

That is, the effective tax rate for the first S$200,000 of taxable profits of all Singapore companies is 8.2875%!

– Pioneer Certificate Incentive Companies with the ‘Pioneer Certificate’ designation can enjoy tax exemptions for up to 15 years. If your business is related to research and development, IT or an industry that has not yet been launched on a large scale, your company can apply for Pioneer status.

– Development and Expansion Incentive offers a concessionary tax rate of 5% or 10% for companies developing new or expanding businesses, provided they are beneficial to the overall economy of Singapore.

– Singapore International Trader Concession

To encourage global traders to trade internationally in Singapore, a reduced corporate income tax rate of 5% or 10% for 5-10 years is offered to government-approved “global traders”; this concession is assessed by the International Enterprise Singapore (IES).

– Singapore Finance and Treasury Centre Incentive

This policy is to encourage multinational companies to set up Finance and Treasury Centres (FTCs) in Singapore to engage in finance, financing and other financial services. FTCs can claim a concessionary corporate income tax rate of 10% on income derived from eligible activities for a period of 10 years, renewable up to a maximum of 20 years

– Singapore Regional/International Headquarters Scheme

Multinational companies that locate their Regional Headquarters (RHQ) or International Headquarters (IHQ) in Singapore are entitled to a lower corporate income tax rate of 15% for 3-5 years for RHQs and 10% or less for 5-20 years for IHQs.

The main purpose of this policy is to encourage multinational companies to locate their regional or international headquarters in Singapore. Specific incentives can be negotiated with the Enterprise Development Board (EDB), which can tailor the package to suit the size of the company and its contribution to Singapore.

The Singapore government’s Regional Headquarters (RHQ) scheme attracts multinational companies to set up regional headquarters in Singapore (e.g. for South East Asian activities) through tax incentives such as the following tax incentives for RHQ companies that can meet the minimum requirements of having at least S$500,000 in capital and at least S$5 million in annual business expenditure in Singapore.

– A 15% tax on incremental taxable income.

– A 3-year tax exemption with a 2-year extension

– Multinational companies that exceed the minimum requirements of the Regional Headquarter Incentive Scheme (RHQ) may be eligible for International Headquarter (IHQ) incentives, which are more generous, such as

– 0, 5% or 10% tax on taxable income, depending on the contribution, negotiated with the Singapore Economic Development Board.

– A tax holiday of 5 to 20 years.

Taxable income for regional and international headquarters is defined as income from management, technical assistance and other support services, as well as taxable interest and licence fees. Singapore exempts dividends received by regional or international headquarters from tax and exempts dividends paid by regional and international headquarters from withholding tax.

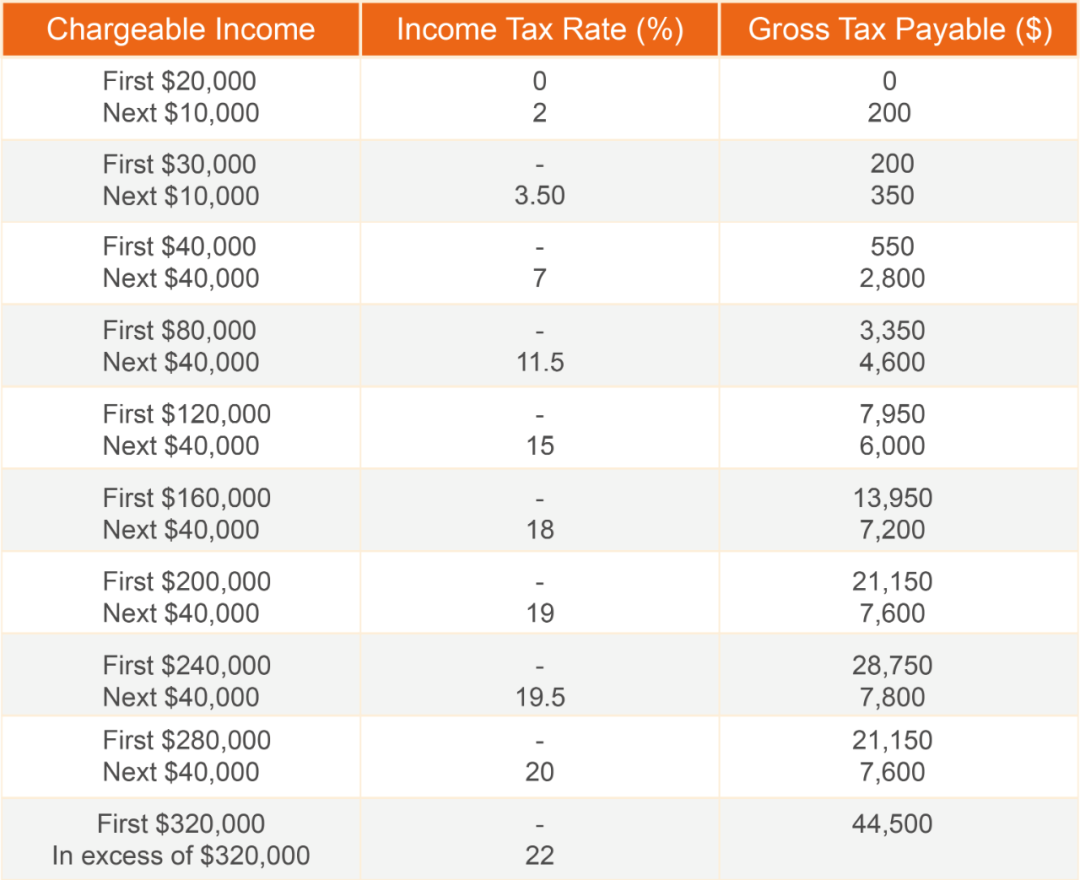

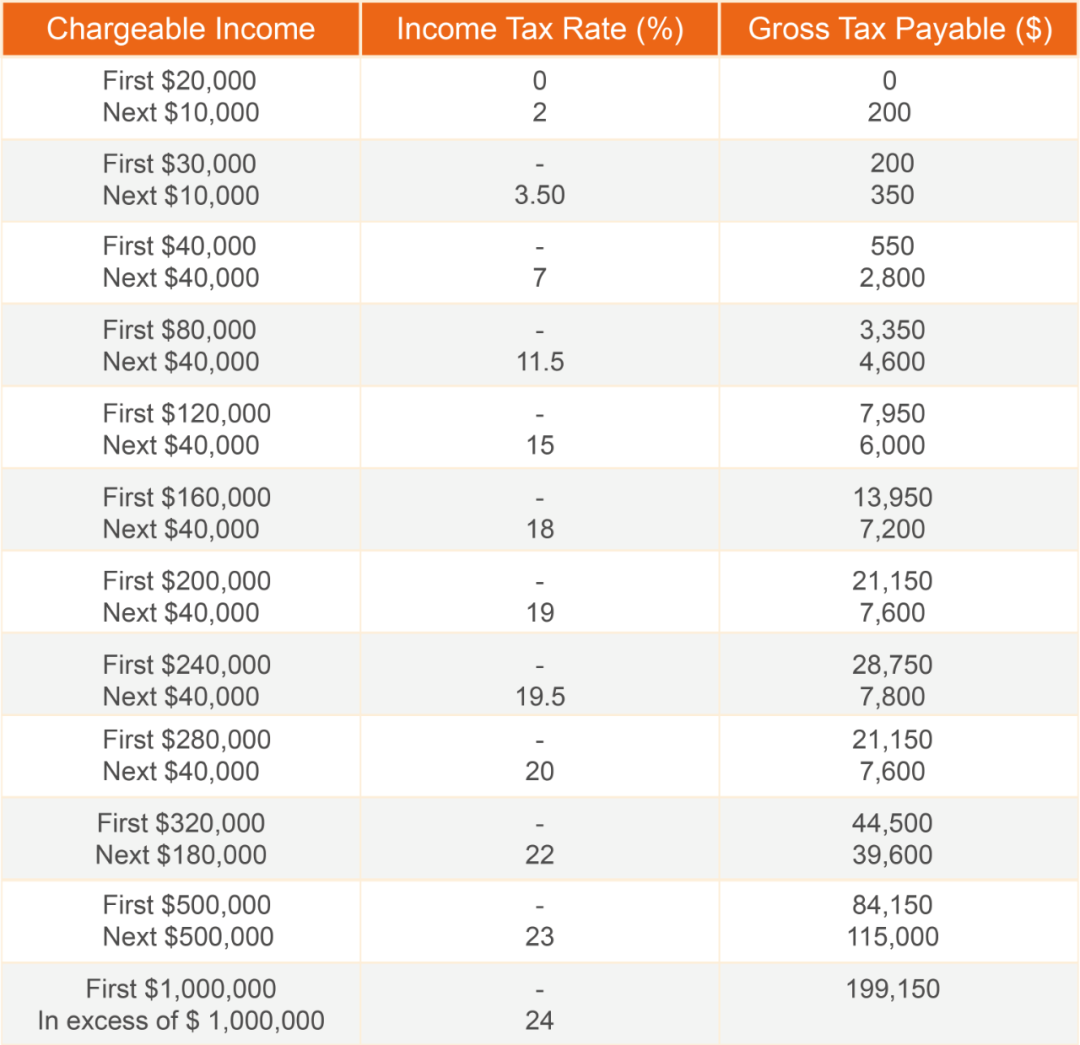

From 2024 onwards, the maximum personal income tax rate will be increased to 24%

A business needs to register for GST if its GST-chargeable business income for the current year or its GST-chargeable income for the next 12 months is expected to exceed S$1 million.

A registered GST taxpayer.

-Require to file and pay GST on a regular basis (usually monthly or quarterly), and are allowed a credit for input tax incurred on the purchase of goods and services

-If the GST payable for the period is not sufficient to offset the input tax incurred, the GST taxpayer can apply to the tax authorities for a refund of the difference between the actual input tax incurred and the output tax payable

Concessions.

The zero GST rate is applicable when certain conditions are met for income derived from services provided by a Singapore enterprise to an offshore enterprise.