Over the last few months, China has been quickly expanding the pilot program on electronic special value-added tax (VAT) fapiao (hereafter referred to as special VAT e-fapiao). First trialed in Ningbo, Hangzhou, and Shijiazhuang, China expanded the pilot program on issuing special VAT e-fapiao to 11 regions from December 21, 2020 and then another 25 regions from January 21, 2021. China is accelerating its effort to join the booming trend throughout the world: digitalization.

In this article of China Briefing magazine, we will walk you through China’s developing e-fapiao system by introducing what it is, explaining why it matters, and exploring the potential challenges associated with the implementation.

1.What is e-fapiao?

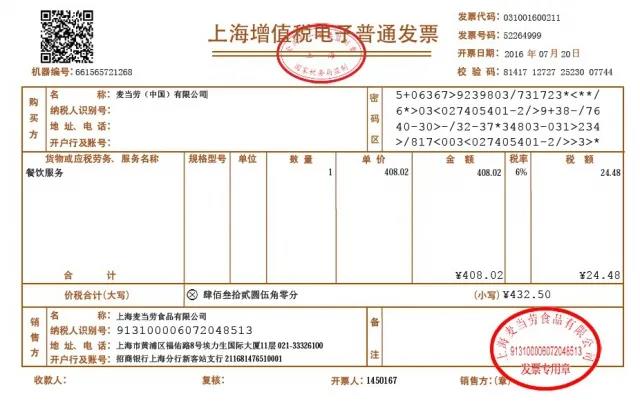

E-fapiao, as the name suggests, is a type of fapiao in electronic form. It has the same purpose and legal effect as the conventional paper fapiao.

Despite the similar appearance of an e-fapiao and the scanned copy of a paper fapiao, the two are different in nature:E-fapiao is a data file that is generated in the official tax system in a structured format. It is easier for financial systems to comprehend, book, and archive automatically. And it adopts technical anti- counterfeiting measures, such as electronic signature, to ensure its authenticity.The scanned copy of a paper fapiao just mirrors information of the corresponding paper fapiao and doesn’t contain the original anti-counterfeiting measures possessed by the paper fapiao, which are mainly physical measures, such as special printing ink, the printing font, the company fapiao chop, etc. It can’t be regarded by the tax bureau as an “original” fapiao in the way the e-fapiao can be.

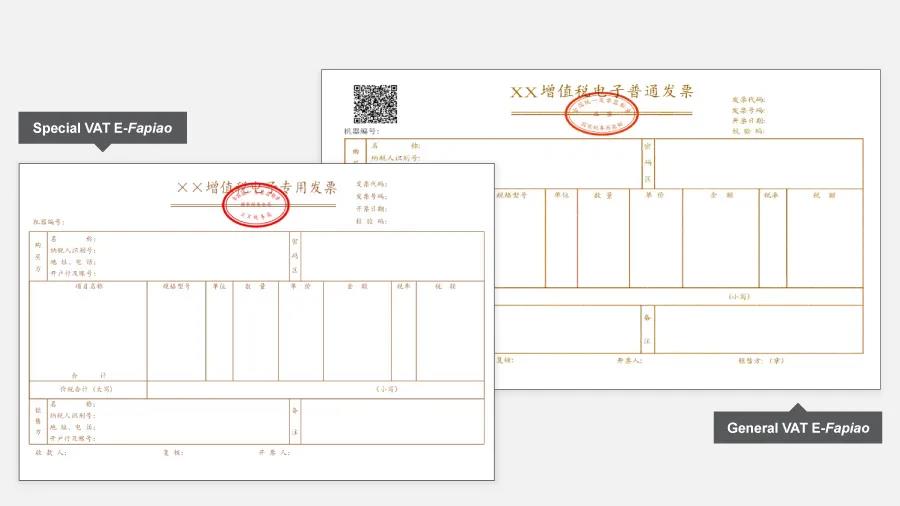

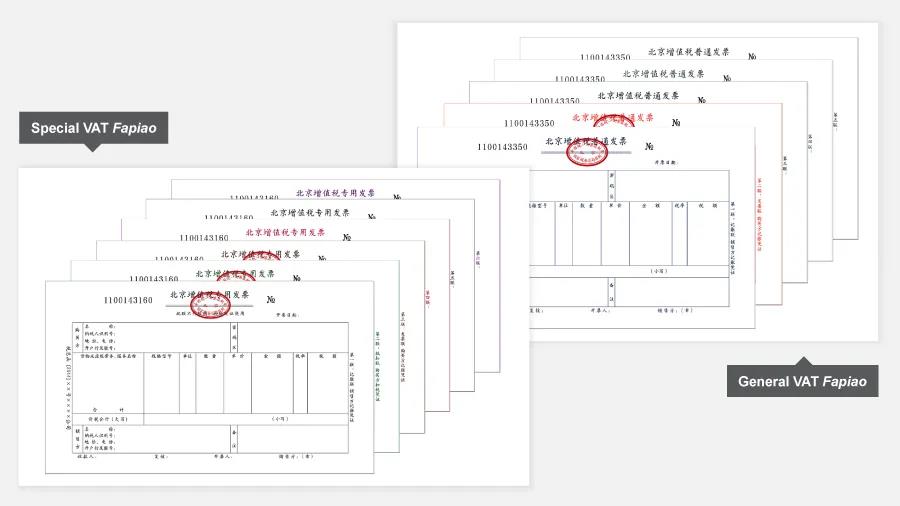

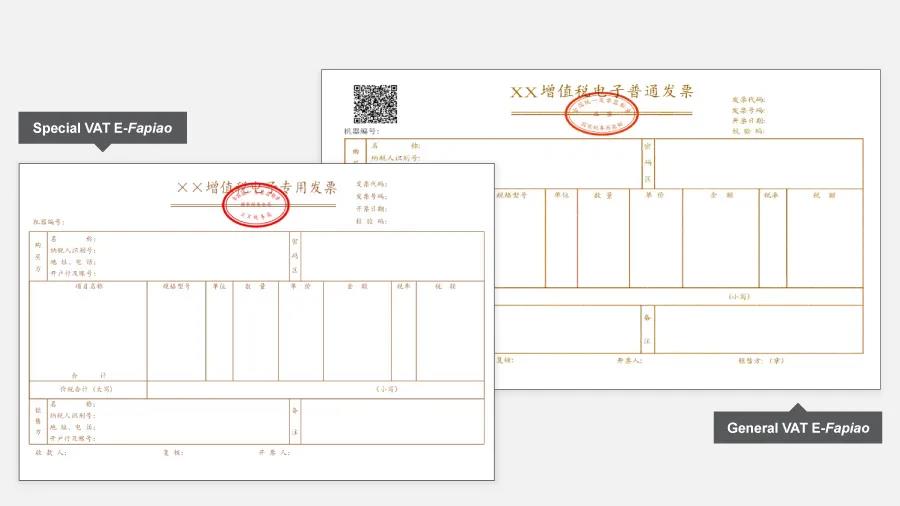

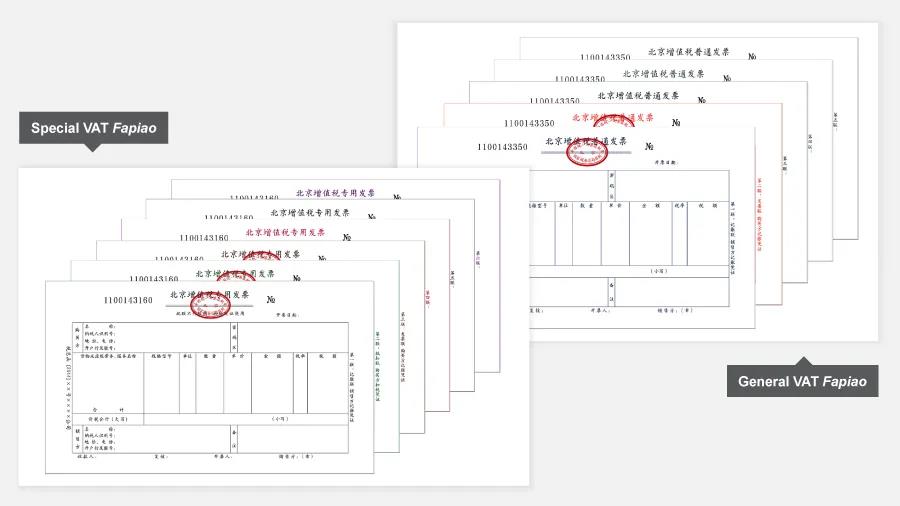

Similar to paper fapiao, e-fapiao are also divided into two types: general VAT e-fapiao and special VAT e-fapiao, but in contrast to paper fapiao for which multiple duplicate copies are issued via the special printer, e-fapiao (whether general or special versions) only exist as a single data file. Examples of e-fapiao are shown below.

2.Advantages of e-fapiaoBecause of the digital nature of e-fapiao, it comes with added benefits for both taxpayers and tax administration.

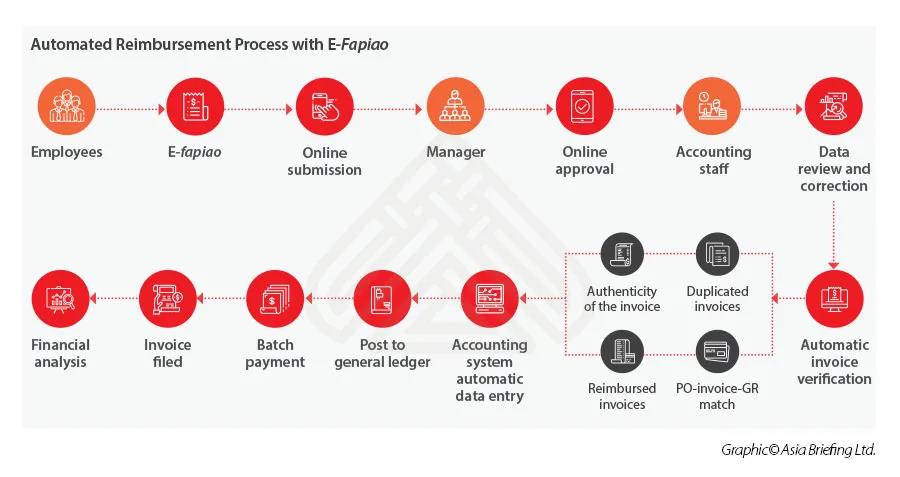

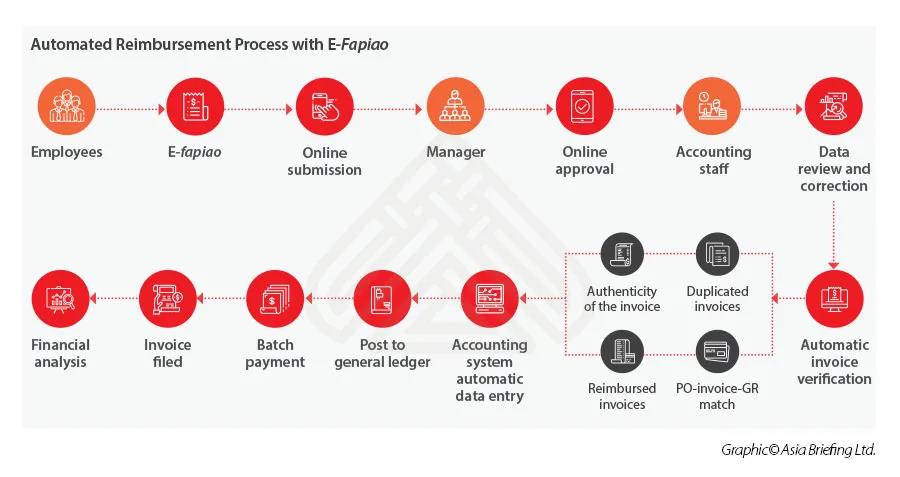

Being easier to obtain, issue, deliver, and store, the new invoicing process will lead to more cost-effective and environmentally friendly business practices. Besides, considering e-fapiao is easier to search for at a later date, to retrieve when needed, and more suitable for automation, the whole financial and accounting process can be expected to be more streamlined, efficient, and accurate with improved data quality. The business environment and general market vitality can be expected to be improved as a consequence.

3. Why does it matter?

The implementation of e-fapiao will not only initiate a revolution within the traditional financial and accounting processes of a business, but also will significantly affect the whole business operation and supply chain management. Below we explain why.

E-fapiao is related to all businesses

E-fapiao will affect businesses sooner than expected

E-fapiao has imposed new compliance requirements on the financial and accounting processes

E-fapiao requires software installment and system upgrade

E-fapiao will affect businesses sooner than expected

E-fapiao offer a great opportunity for enterprises to further automate and optimize their operations Please note that not only the financial and accounting processes will be affected. The implementation of e-fapiao and associated improved automation will also help to optimize other key operations, such as supply chain management, client relationship management, reporting, etc.In the context of the tax bureau’s determination to achieve advanced tax administration through information technology, the implementation of e-fapiao is imperative. The digital nature of e-fapiao will bring multiple benefits to businesses in achieving higher accuracy, higher efficiency, and higher levels of automation.However, on the other hand, the e-fapiao implementation also impose challenges on businesses in the short-term to understand the laws and regulations, develop relevant internal protocols, revise standard business processes, and upgrade relevant software and equipment to comply with the new reimbursement, bookkeeping, and archiving requirements.It’s important that companies get prepared and develop a thorough strategy for e-fapiao to alleviate operational risks and get the most out of the e-invoicing trend.

Please note that not only the financial and accounting processes will be affected. The implementation of e-fapiao and associated improved automation will also help to optimize other key operations, such as supply chain management, client relationship management, reporting, etc.In the context of the tax bureau’s determination to achieve advanced tax administration through information technology, the implementation of e-fapiao is imperative. The digital nature of e-fapiao will bring multiple benefits to businesses in achieving higher accuracy, higher efficiency, and higher levels of automation.However, on the other hand, the e-fapiao implementation also impose challenges on businesses in the short-term to understand the laws and regulations, develop relevant internal protocols, revise standard business processes, and upgrade relevant software and equipment to comply with the new reimbursement, bookkeeping, and archiving requirements.It’s important that companies get prepared and develop a thorough strategy for e-fapiao to alleviate operational risks and get the most out of the e-invoicing trend.

Please note that not only the financial and accounting processes will be affected. The implementation of e-fapiao and associated improved automation will also help to optimize other key operations, such as supply chain management, client relationship management, reporting, etc.In the context of the tax bureau’s determination to achieve advanced tax administration through information technology, the implementation of e-fapiao is imperative. The digital nature of e-fapiao will bring multiple benefits to businesses in achieving higher accuracy, higher efficiency, and higher levels of automation.However, on the other hand, the e-fapiao implementation also impose challenges on businesses in the short-term to understand the laws and regulations, develop relevant internal protocols, revise standard business processes, and upgrade relevant software and equipment to comply with the new reimbursement, bookkeeping, and archiving requirements.It’s important that companies get prepared and develop a thorough strategy for e-fapiao to alleviate operational risks and get the most out of the e-invoicing trend.

Please note that not only the financial and accounting processes will be affected. The implementation of e-fapiao and associated improved automation will also help to optimize other key operations, such as supply chain management, client relationship management, reporting, etc.In the context of the tax bureau’s determination to achieve advanced tax administration through information technology, the implementation of e-fapiao is imperative. The digital nature of e-fapiao will bring multiple benefits to businesses in achieving higher accuracy, higher efficiency, and higher levels of automation.However, on the other hand, the e-fapiao implementation also impose challenges on businesses in the short-term to understand the laws and regulations, develop relevant internal protocols, revise standard business processes, and upgrade relevant software and equipment to comply with the new reimbursement, bookkeeping, and archiving requirements.It’s important that companies get prepared and develop a thorough strategy for e-fapiao to alleviate operational risks and get the most out of the e-invoicing trend.