How to Register LFMC (Retail) License in Singapore?

If a company raises and manages third party investors’ funds in a collective investment scheme, or invest them in a segregated accounts into capital markets products, such as equities, fixed income and financial derivatives, it is conducting fund management and would need to be licensed or registered to do so.

Q What is LFMC (Retail) license In Singapore?

A LFMC retail is the highest level of license available to the Fund Management Companies in Singapore. This license does not have any restriction on the classes of investors you can deal with, the classes of investment products you can invest in or the quantum of assets under management.

However, because this license has no restrictions as to the any of the point above, the conditions and compliance requirements are the most stringent here.

Q Who is a Retail Investor?

A Any investor who is not an Accredited Investor is assumed to be a retail investor. But in simple terms, Mr. John Doe, who stays in your HDB block and works for a local school, is a typical example of a retail investor. Retail investors need more protection in terms of financial decision-making. So in this license, there are more safeguards to ensure such investors are protected well.

Q What are the applicable requirements?

A Minimum Base Capital

Every LFMC (Retail) is required to have a minimum base capital of 500,000 SGD. Please note minimum base capital does not refer to the share capital of the legal entity. This is the amount you should always have in your accounts as a solvent company. So generally, it is recommended to have enough buffer in the capital. LFMC is always required to assess the capital buffer and take necessary steps to bring it in line with a legal requirement.

If the LFMC is going to offer collective investment scheme (CIS) products to retail investors, then this minimum base capital requirement is raised to 1,000,000 SGD.

Risk Based Capital

LFMC is subject to Risk-based Capital maintenance requirements. Every LFMC (Whether A/ I or retail) is required to maintain risk based capital of 120% of its calculated risk.

Office Requirement

LFMC should be a Singapore incorporated company and have a permanent physical office in Singapore. The office should be dedicated, secure and accessible only to the FMC’s directors and staff. A unit in serviced office is acceptable however, co-working spaces do not qualify as an office for FMC as it is not considered dedicated and accessible only to the staff. If located in a serviced office, then your office must be an independent unit accessible to your staff only. Similarly, you are also required to take proper care and caution for safeguarding your IT equipment which may be located outside your premises but in the data center.

AML / CFT Requirements

A LFMC (Retail) shall comply with the requirements on antimoney laundering and countering the financing of terrorism [“AML/CFT”] requirements, as set out in the Notice to Capital Markets Service Licensees and Exempt Persons on Prevention of Money Laundering and Countering the Financing of Terrorism [SFA04-N02].

Reporting of Misconduct

All LFMCs shall comply with the misconduct reporting requirements set out in the Notice on Reporting of Misconduct of Representatives by Holders of CMS Licence and Exempt Financial institutions [SFA04-N11].

Compliance Function

Retail LFMCs are required to have their own independent compliance department in Singapore. Outsourcing of this function is not allowed as in other licenses. The compliance function must be appropriately staffed commensurate with the size and complexity of the fund.

Audit and Internal Audit

LFMC are subject to an annual audit and also internal audit.

Risk Management Framework

Retail LFMC shall put in place a risk management framework to identify, address and monitor the risks associated with customer assets that it manages, as required by regulation 13B(1)(a) of the SF(LCB)R. The FMC should take into account the principles set out in the MAS Guidelines on Risk Management Practices that are applicable to all financial institutions and any other industry best practices that might be relevant. An FMC should also be cognizant that these risks are dependent on the nature and size of its operations and the nature of assets that it manages.

Professional Indemnity Insurance (PII)

For a retail LFMC, it is mandatory to have PII coverage. The amount of coverage depends on the size of funds under management. Generally, the insurance coverage should be 2-3% of the total AUM. A Retail LFMC may apply to MAS to exempt them from having PII, however in that case a letter of undertaking from the parent company to provide necessary capital in case of any isssues will be required.

License fees to be paid to MAS

4000 SGD at the time of registration.

Staffing Requirements

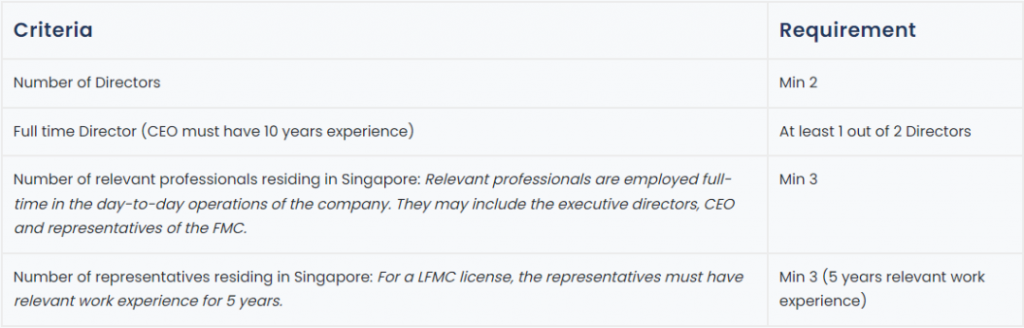

A Retail LFMC is required to appoint an adequate number of directors, relevant professionals and representatives as set out in the table below. It must also appoint a Chief Executive Officer [“CEO”]. There is no restriction on the CEO to take on multiple appointments within the firm if there are synergies, e.g. the CEO can also be appointed as Executive Director, relevant professional and representative. The individual would then need to meet the requirements in respect of each appointment.

Q What is the processing time required?

A The expected processing time is 4 months to review and process an application if the business model is straightforward, the applicant meets the relevant admission criteria fully, and the application is complete and clear. For more complex cases, or cases where information is assessed to be incomplete or inaccurate, MAS will need a longer time to review the application.

It is therefore important that you use a professional firm like ours to process your application with MAS. Please ensure that your company’s application is complete, correct and accompanied by the requisite supporting documents.

Q Annual Compliance you will be subjected to?

A Every Retail LFMC, within 5 months after the accounting year is required to file;

Statement of Assets and Liabilities

Statement of Financial Resources, Total Risk Requirement and Aggregate Indebtedness

Statement relating to the Accounts of a Holder of a CMS Licence

Statement relating to the Accounts of a Holder of a CMS Licence – Supplementary Information

Auditor’s Report – For a Holder of a CMS Licence

Auditor’s Certification – For a Holder of a CMS Licence

Audited financial statements (balance sheet and profit and loss statement) for the latest completed financial year

Every LFMC is also required to file with MAS, following two documents on a quarterly basis.

Statement of Assets and Liabilities

Statement of Financial Resources, Total Risk Requirement, and Aggregate Indebtedness

How Singapore Compliance can help?

From the above it should be clear to you that applying for Retail LFMC license is not an easy task. Often times MAS requires additional clarifications and if the documents provided are not clear then the process can get delayed resulting in a significant loss of time.