(Elite Stage’s gift: 83 pages of electronic document “The Impact of the War in Ukraine on Global Trade and Investment” is available for free within a limited time! )

In 2004, China formally issued regulations on the outbound direct investment (ODI) of Chinese enterprises. A decade later, in 2014, China made overall adjustments to the ODI regulatory system, transforming from the approval system to the filing system (that is, filing is generally required for normal ODI projects, and approval is only required in special case”).In 2017, under the principle of the filing system, the relevant departments further established a supervision principle based on classification (encouragement, restriction and prohibition) and the nature of the projects in practice. Since then, both from the perspective of overall regulatory principles or specific regulatory measures, China has established a complete ODI regulatory legal system.

Nevertheless, against a background of an increasingly well-placed situation for Chinese enterprises in investment and M&A transactions around the world, many of them still lack understanding of the application procedures of ODI projects and the requirements of “substantive review” and “case-by-case review”, and there are a large number of cases where the applications fail due to the improper implementation of ODI procedures or inadequate preparation.

Under the current regulatory system, once there are flaws in the ODI procedure, enterprises do not have the opportunity to “supplement” materials and “correct” mistakes afterwards. This may also affect enterprises that fail to properly implement ODI procedures in terms of compliance in operation, follow-up transactions of overseas investment projects (equity sale or introduction of new investors, and repatriation of funds), and even future listing of enterprises.

In order to better help enterprises understand the regulatory requirements and operational practices of ODI, this article analyzes and sort some of the mostfrequently encountered problems in ODI applications, including the following:(1) assessing whether the project needs to apply for ODI;(2) ODI application timing;(3) ODI applicant (how to deal with multiple applicants);(4) use of “route company”;(5) how to define “overseas reinvestment”; (6) simultaneous acquisition of multiple projects under the same control abroad;(7) the impact of the JV party/counterparty’s overseas investment procedure on the ODI application.

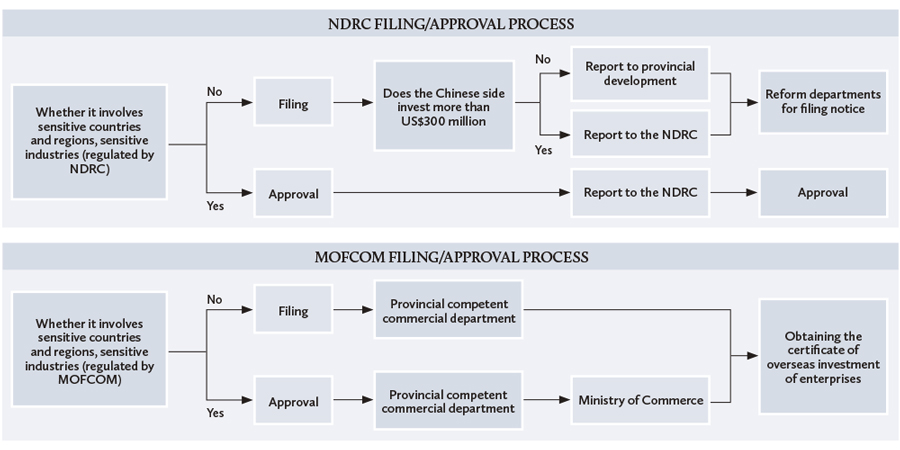

The current supervision system:three-way supervision and varied dimensions of review . Under the current legal system, the ODI projects carried out by Chinese enterprises are mainly supervised by the National Development and Reform Commission (NDRC), the Ministry of Commerce (MOFCOM) and the State Administration of Foreign Exchange (SAFE).The NDRC and the commissions of commerce are responsible for the review of ODI projects, while SAFE controls the remittance of funds

In the ODI application process, enterprises need to obtain the approval of or file with the NDRC and MOFCOM, and then apply to banks for remittance of funds within the approved quota of foreign currency. The general enterprise ODI application procedure is shown in the figure below

Supervision principles of ODI authorities case-by-case review, varied dimensions and full and whole-process supervision. For each ODI project, the competent authorities will conduct a comprehensive review of the specific investment mode, investment destination, business background, investment amount of the project, etc., and make a decision on whether to agree to file or not.For example, for merger and acquisition ODI project applications, local authorities usually require the submission of a due diligence report by professional institutions such as law firms for overseas target companies as a basis for evaluating the authenticity and rationality of the project.

It should be noted that there are differences in the strictness of review, the understanding of laws and regulations, and the acceptance of complex and special projects among the local competent authorities.For example, some local authorities tend to hold a negative attitude towards the final remittance of funds from ODI projects to the domestic subsidiaries of overseas companies, while some will not pay special attention to it. It is suggested that enterprises should understand the differences and prepare before applying by communicating with the competent authorities or consulting professional advisers.

The competent authorities will not only intervene and implement supervision at the stage of filing/approval. Enterprises also have the obligation to report to ODI authorities in advance (before the implementation of the project) and afterwards (after the completion of the investment) for ODI projects, and the supervision of the competent authorities actually covers the whole process of overseas investment activities. Enterprises’ failure to fully fulfil the relevant reporting obligations may also lead to defective records of ODI projects with the competent authorities.

Whether a project needs to go through ODI procedures.

The definitions of “overseas investment” are not entirely consistent in the relevant regulations of the National Development and Reform Commission (NDRC) and the Ministry of Commerce (MOFCOM). In practice, the focus of the authorities in their reviews is whether domestic entities have obtained overseas interests, including corporate ownership, rights of control, and management controls.An ODI application is only required if a Chinese enterprise receives overseas interests. Taking the overseas lending of a domestic enterprise as an example, if the funds are provided to overseas affiliated parties for operations, it is merely an act of lending. The enterprise has not obtained overseas interests and thus does not need to go through ODI procedures.However, if the funds are lent to overseas affiliated parties, who will in turn use such funds to acquire equity interests of an overseas enterprise, the lender will be deemed to have obtained overseas interests through the remittance of domestic funds, in which case ODI applications become necessary.

When to make an ODI application.

According to the practice of most local development and reform commissions, an ODI application should be made before the applicant obtains the rights and interests of the overseas enterprises, even if at this point the applicant has yet to make an investment, or any consideration to the overseas enterprise. The practice of MOFCOM is the same.On the basis of the above criteria, if and when a domestic enterprise receives warrants issued by an overseas enterprise, it has not obtained any overseas interests, hence there is no need to go through the ODI procedures. The application obligation should be fulfilled when it exercises the warrants in the future.

ODI applications involving multiple domestic entities.

Generally, domestic enterprises that intend to invest abroad are the applicants for ODI projects. However, some projects involve multiple domestic entities, and which party should apply for the ODI requires specific analysis.When a new ODI project involves multiple domestic investors, the main investor should be the applicant. As for an additional investment, or transfer of shares of an overseas project that has already been through ODI procedures, the standards of review from the two departments are completely different.The NDRC regards the above-mentioned situation as an independent and new ODI project, and requires the party with the highest investment (in the current round) to make an ODI application. However, the MOFCOM views it as a change to the original ODI project, and requires the domestic investor with the highest shareholding ratio in the investment project to be the applicant for the ODI change.If the applicant of the ODI project changes during the process, for example, the applicant of the previous round will no longer be the majority shareholder after the completion of the new round of investment, and the project will be transferred from the original filing commercial department to the local commercial department where the new applicant is located for review.

The use of route companies.

For tax and shareholding structure optimization purposes, many enterprises choose to set up one or more layers of overseas entities between them and their destination enterprises, which are the route companies in the context of ODI. Both NDRC and MOFCOM adopt the “penetrative” principle and focus their reviews on the enterprises that the funds eventually flow into, and only require filing or approval for ODI for such destination enterprises.There is no requirement of application for the establishment of route companies, but the applicant needs to fully disclose its investment route (that is, each layer of the route companies).

Equity transfer of the ODI projects with unfinished investment.

For projects that have completed ODI filing/approval, equity transfers can be made before the investment is fully completed. Both departments regard it as a change to the original project.

Applications for overseas reinvestment projects.

The authorities supervise the entire process of overseas investment, including the reinvestment made by destination enterprises that have already processed ODI applications. According to the authorities, the investment made by the destination enterprise, using its operating profits or self-raised funds from overseas, constitutes an overseas reinvestment. In contrast, if the funds originate from the domestic enterprises (e.g., through capital increase or lending), the investment will be regarded as an outbound investment from the domestic enterprise, instead of an overseas reinvestment.For reinvestment, the MOFCOM requires a post-reporting. The NDRC has no procedural requirements in principle, except for the following situations:(1) where sensitive industries are involved;(2) where the investment made by the Chinese party exceeds US$300 million.

Simultaneous acquisition of multiple overseas projects under the control of the same domestic enterprise.

In practice, domestic investors may acquire multiple overseas projects held by the same domestic enterprise through its overseas entity (such as a holding company or platform). There may be two specific scenarios: one is the direct acquisition of an overseas holding platform, and the other is the acquisition of equity in a single overseas project company.The first thing to note is that if the project has defects in the previous ODI procedures, the investor will have a high chance of not being able to obtain ODI filing or approval for this project. Also, a direct acquisition of the holding platform may seem convenient, but the applicant may face obstacles. If the holding platform company has not previously been ODI-registered as the destination enterprise, or only registered as a “route company”, it is very likely that the authorities will reject the filing/approval in practice.

In terms of ODI applications for each project, there are operational difficulties and uncertainties as to whether the filings/approvals for different projects can be completed simultaneously, and it is likely that acquisition transactions cannot be made in one package. It is recommended that enterprises consider flexible arrangements, such as project-by-project closing, in similar complex transactions to deal with the uncertainty of the ODI procedures.Elite Stage has always been committed to providing customers with comprehensive and reliable company services, in-depth understanding of the customer’s operating model to provide the most appropriate method, helping customers do offshore investment successfully, and enabling customers to operate legally in worldwide.

If you are interested in worldwild investment, we have prepared an electronic document “The Impact of the War in Ukraine on Global Trade and Investment” to let you know more about the markets and challenges in Asian countries.

Because of limited space, please add our consultant WeChat (Wechat ID: Elitestage) below, and we will send you the full version for free.

⬇⬇⬇

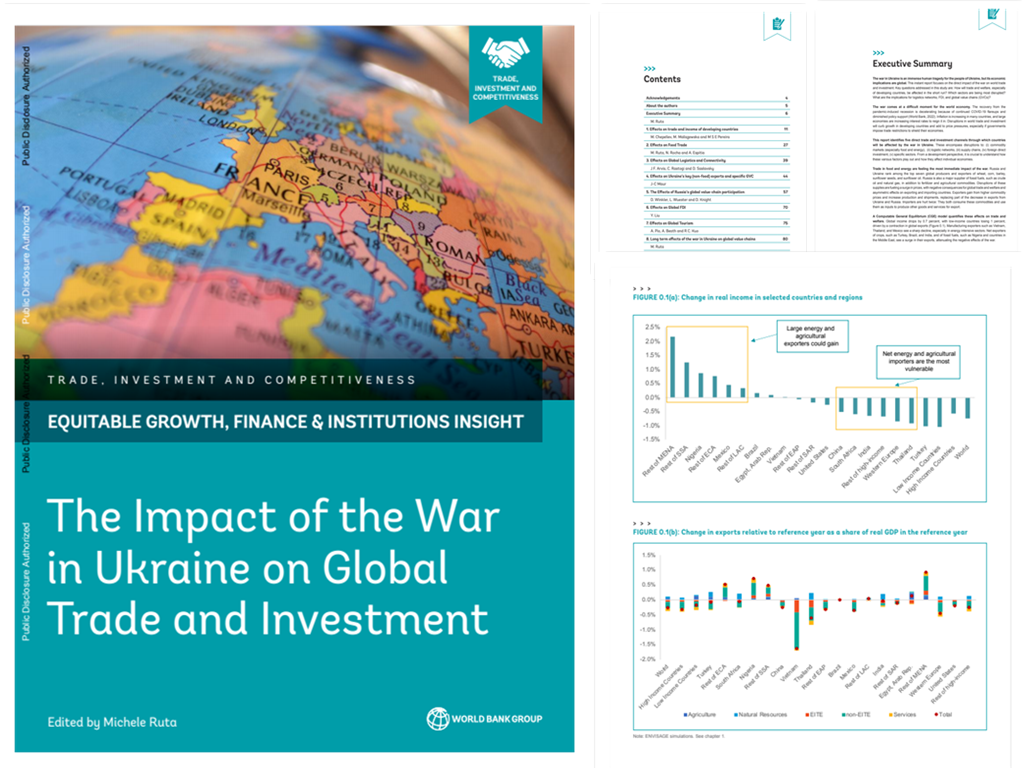

The Impact of the War in Ukraine on Global Trade and Investment