Offshore Structure: Singapore VS Hong Kong Company Comparison

Singapur has one of the lowest corporate tax rates in the world, excluding capital gains tax, and is ranked number one in the World Banks Ease of Doing Business Index each year.Thanks to its simple tax system and low wages for companies and individuals, Hong Kong has become a popular financial center, occupying a prominent position in Central Asia. They develop talent skills that are ready to be developed for the economy.

Singapur has one of the lowest corporate tax rates in the world, excluding capital gains tax, and is ranked number one in the World Banks Ease of Doing Business Index each year.Thanks to its simple tax system and low wages for companies and individuals, Hong Kong has become a popular financial center, occupying a prominent position in Central Asia. They develop talent skills that are ready to be developed for the economy.

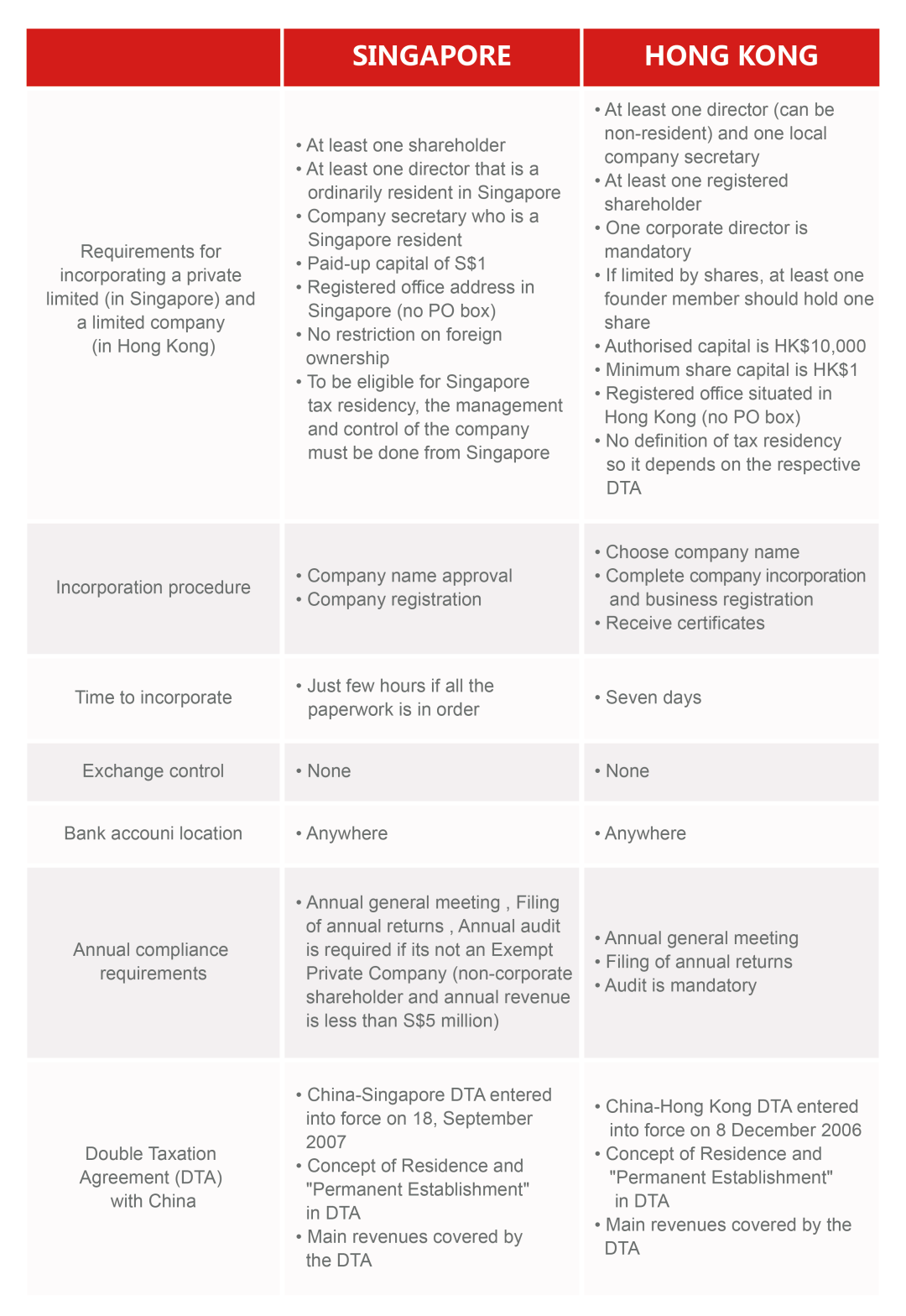

We compare the incorporation requirements of the two jurisdictions below:

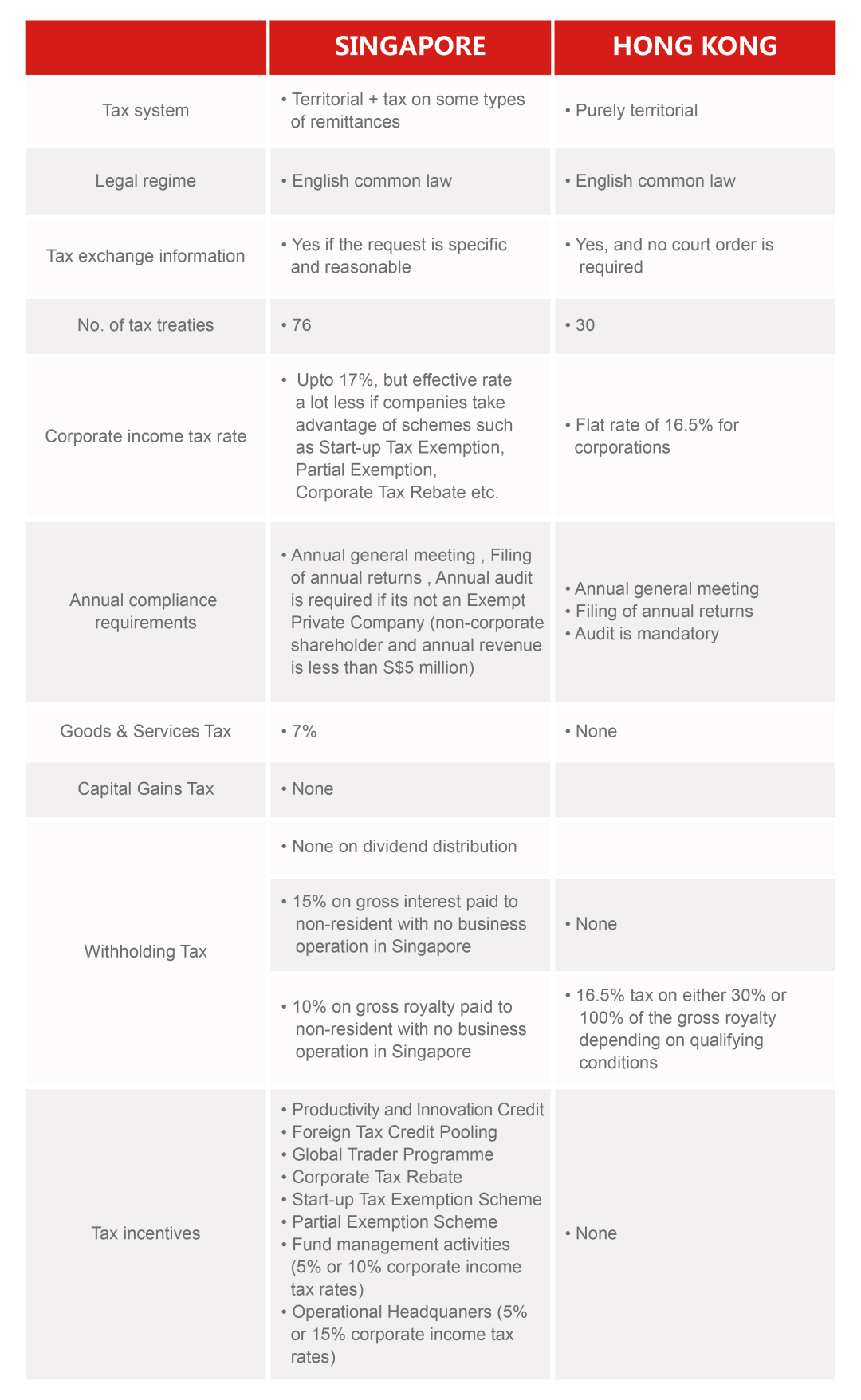

Filing Profit tax return (PTR) as in the case of Hong Kong company, or Estimated Chargeable Income (ECI) and tax return as for companies in Singapore. An annual audit is required if a company is not considered a small one in Singapore. However, in Hong Kong, the annual audit is mandatory.

Additionally, the records of the accounting activities, the minutes of meeting, and registers of company particulars must be maintained in case of periodic inspection by the government officers.

In Singapore, there are two government authorities responsible for the formulation and deception of most of the statutory requirements governing local companies: Accounting and Corporate Regulatory Authority (ACRA) – national companies registries where to file annual return, and Inland Revenue Authority of Singapore (IRAS) – national tax authority where to file ECI and annual tax return.

In Hong Kong, things go in the same direction. However, there is a bit difference in the name of the authorities. Whereas in Singapore, there are ACRA and IRAS, in Hong Kong, the file will be sent to the Companies Registry (CR) and the Inland Revenue Department (IRD).

Each of them who meet the qualification above can start setting up company or be employed under different types of work pass subject to their respective criteria such as EntrePass (Entrepreneur Pass – a word pass permits entrepreneurs who want to start and operate a new business in Singapore) or Employment Pass.

Turning to Hong Kong, nationals of about 170 countries and territories are allowed visa-free visits to this destination for periods ranging from 7 to 180 days. Short-term visitors are allowed to enter Hong Kong on a visitor visa to conduct their business negotiations and sign contracts.

Besides, the government has also introduced appropriate work visa provisions, to cater to the needs of entrepreneurs who may wish to relocate to Hong Kong to run their business or who may want to hire foreign professional employees to work in their company, or those who would like to move to the country for lawful employment purpose.

Wise investors or entrepreneurs will always spend their time evaluating the cost of living before going to final decisions in the incorporating process. ECA Internationals rank in 2019 shows that Hong Kong is ranked as the most expensive city in Asia and fourth in the world. Thus, expatriates have recently preferred Singapore as their destination over Hong Kong.

If you are looking for housing in these jurisdictions, the rental for an apartment in Hong Kong is more expensive than in Singapore, about 47% higher, according to CBREs fifth annual Global Living Report released in April 2019. In regard to education cost, it can be found that tuition fees for children at international schools are lower in Singapore. On the other hand, Hong Kong has been announced to have increased the fee. For those who are seeking domestic help, the costs that related to food and health care are slightly cheaper in Singapore.