【SG】Multinationals Will Be Taxed on Income from Offshore Assets

To address this issue, the Organization for Economic Co-operation and Development (OECD) introduced the BEPS 2.0 framework about two years ago, including a requirement for a minimum effective tax rate of 15 per cent for multinational corporations with an annual turnover of up to €750 million (S$1,070 million) in the second pillar of BEPS 2.0.

As part of broader international action to harmonize the minimum global corporate tax rate for large multinational business groups, the effective tax rate for multinational business groups in Singapore will be topped up to 15 per cent. At the same time, Singapore will review and update broader industry development programs to ensure that Singapore remains competitive in attracting and retaining investment.

BEPS 2.0 is fluid and the government will continue to monitor international developments. Companies will also continue to be engaged and be given adequate notice before any changes in tax rules or schemes.

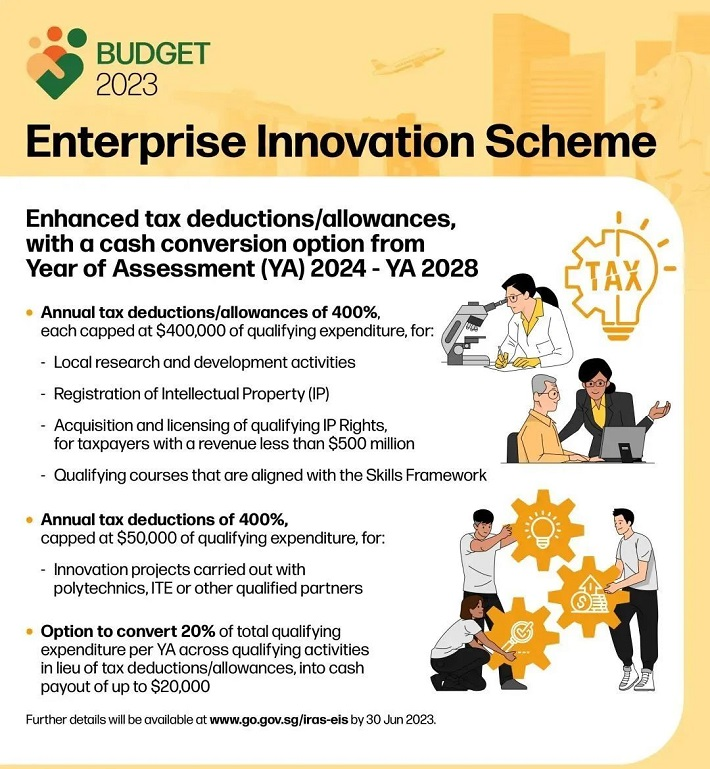

From 2021 to 2025, the Singapore Government will invest $25 billion to boost research, innovation and enterprise. It is also launching a new Enterprise Innovation Programme (EIP), which will significantly enhance tax relief for five key activities in the innovation value chain.

Acquisition and licensing of IPRs;

Innovation with polytechnics and ITE;

training through SkillsFuture Singapore-approved programs aligned to the Skills Framework.

Current businesses can enjoy tax relief of up to 250 per cent of expenditure on these activities. Post-Budget, the tax relief for each of the above five activities has been increased to 400 per cent of eligible expenditure. Eligible expenditure is capped at S$400,000 for each activity, except for innovative activities with polytechnics and ITEs, which are capped at S$50,000 per activity. With these improvements, businesses that take full advantage of the scheme can enjoy tax savings of almost 70 per cent of their investment.

Some companies have yet to turn a profit or are not profitable enough to realize the maximum benefit of the tax cuts. To support these companies, businesses will have the option to convert 20 per cent of their total qualifying expenditure for each year of assessment into a cash payment of up to $20,000. This will help smaller companies cover the costs of their innovative activities, even if they pay little or no tax.