出口退税、免税那些事儿,你都了解吗?

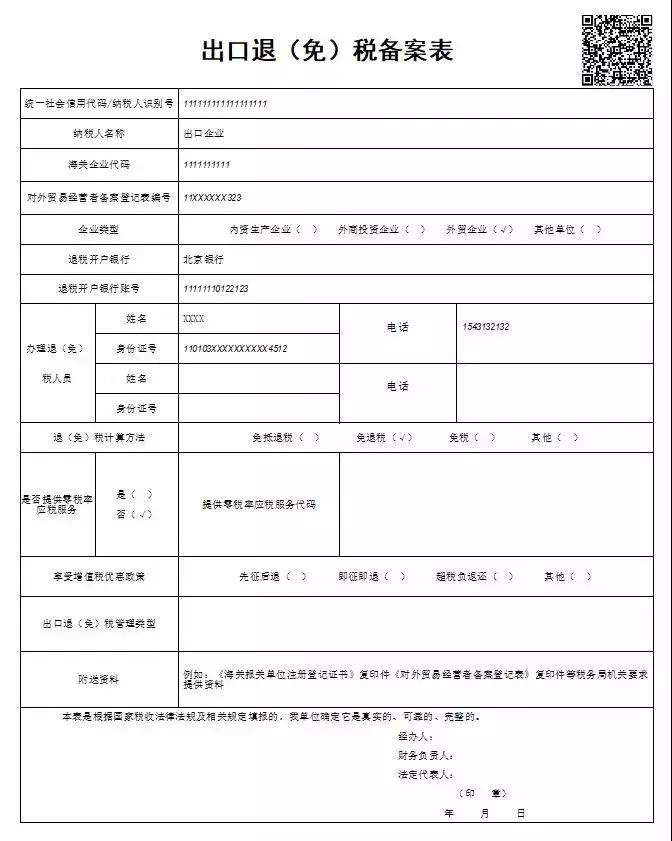

适用出口退(免)税企业范围是?

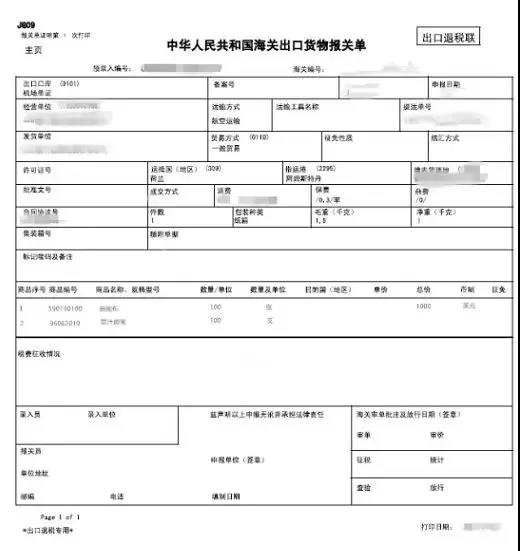

国家税务总局根据上述规定将退税率通过出口货物劳务退税率文库予以发布,供征纳双方执行。退税率有调整的,除另有规定外,其执行时间以出口货物报关单(出口退税专用)上注明的出口日期为准。 import and export license;

目前,我国出口退税率包括13%、9%、6%、0%四档。 VAT or consumption tax in China;

出口退(免)税率的一些特殊规定:

1.外贸企业购进按简易办法征税的出口货物、从小规模纳税人购进的出口货物,其退税率分别为简易办法实际执行的征收率、小规模纳税人征收率。上述出口货物取得增值税专用发票的,退税率按照增值税专用发票上的税率和出口货物退税率孰低的原则确定。

2.出口企业委托加工修理修配货物,其加工修理修配费用的退税率,为出口货物的退税率。 produce evidence that the payment of export transactions has been settled before the end of April the following year. If a long payment term is agreed in the contracts, special filing on the extension of payment terms is required by tax bureau, which shall be finished before the end of April of following year.

File export business with foreign exchange bureau

Apply for a VAT refund license with tax bureau

Site visit

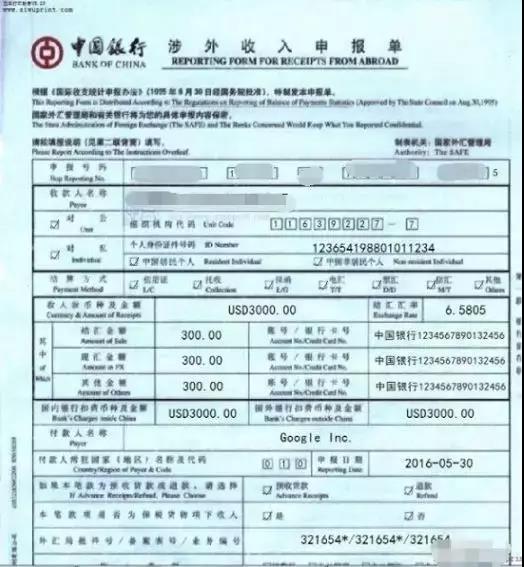

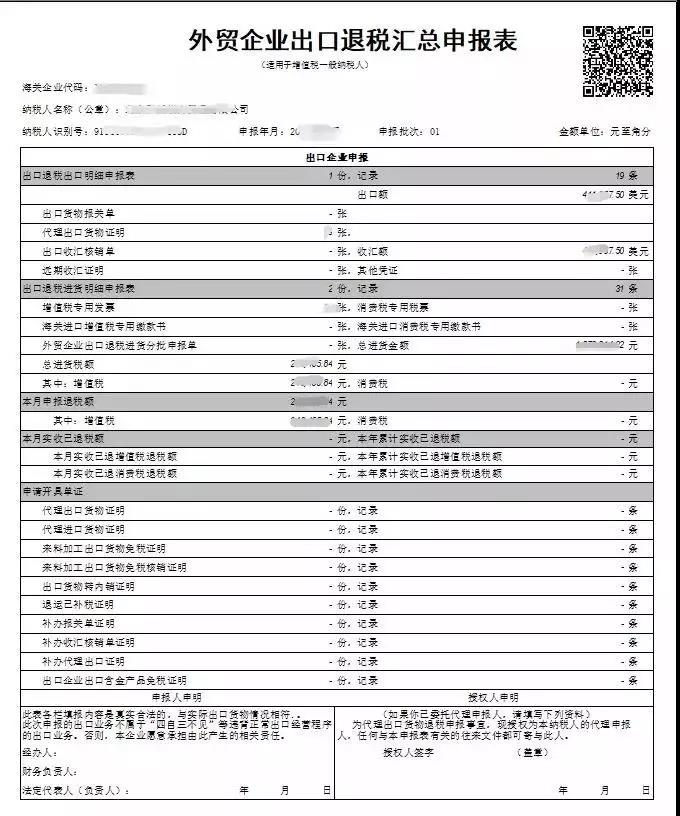

Documentation二、取得报关单、收汇等凭证或电子信息、勾选确认发票,录入出口退税数据申报

三、税务机关审核后,取得退税款

四、会计账务处理

三、税务机关审核后,取得退税款

四、会计账务处理