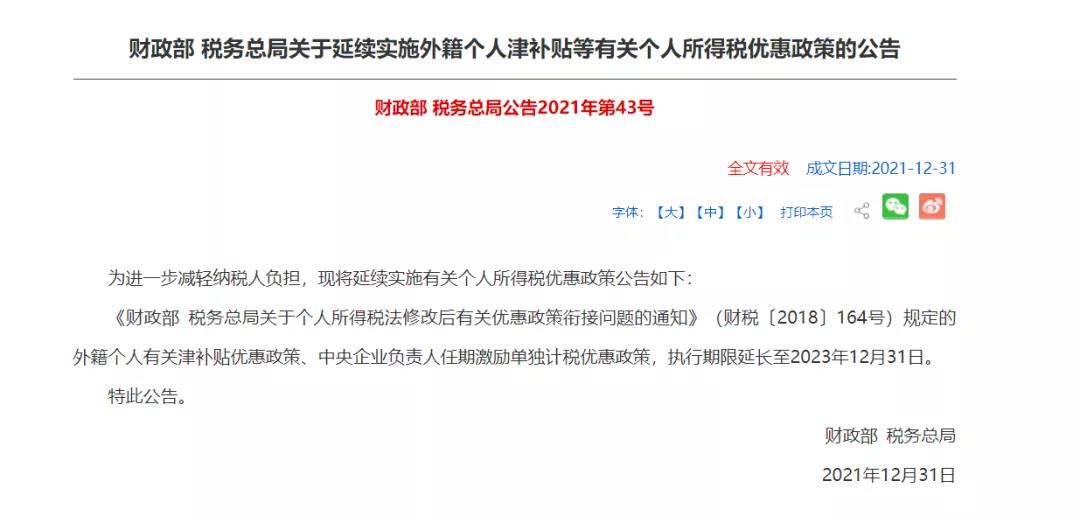

好消息!外籍个人有关津补贴优惠政策获延续

Employer’s Return of remuneration and Pensions

Employer’s Return of remuneration and Pensions

而外籍人士的免税津补贴项目则采取据实合理扣除,也就是根据纳税人所在城市的消费水平,对其具体免税项目依据实际支出情况进行税前扣除。由于各个城市消费能力的差异,因此扣除额度不固定。以房租为例,在北上广深等跨国集团及外籍人士较多的城市,上万元的月租费用一般属于正常范围,但仅房租一项的金额就已超专项附加扣除项目最高抵扣额度的两倍。可见,对于外籍居民个人而言,享受津补贴免税优惠政策的税收有效性远高于专项附加扣除项目。

prepare for the audit in advance!