How to Register LFMC (AI) License in Singapore?

If a company raises and manages third party investors’ funds in a collective investment scheme, or invest them in a segregated accounts into capital markets products, such as equities, fixed income and financial derivatives, it is conducting fund management and would need to be licensed or registered to do so.

Q What is LFMC (Accredited Investor) license In Singapore

A LFMC (AI) is very similar to RFMC license where the assets under management can exceed beyond 250 Million SGD, and there is no limit on the number of accredited investors the fund can engage with. (For RFMC the limit is 30 Accredited investors and AUM below 250 Million Dollars).

If your entity falls in this category, then this is the license relevant for you. Generally what we have seen is clients will often go for RFMC first and then for LFMC when funds under management increase.

Q What is an Accredited Investor?

A Accredited Investors are assumed to be better informed, better able to access resources to protect their own interests, and therefore, would require less regulatory protection. Investors who agree to be treated as Accredited Investors therefore forgo the benefit of certain regulatory safeguards. When the bank deals with Accredited Investors, banks are exempt from complying with certain regulatory requirements of the Financial Advisers Act (FAA), the Securities and Futures Act (SFA) and related regulations that are meant to provide regulatory safeguards to retail customers.

Criteria to qualify as an Accredited Investor

For individuals to qualify to become Accredited Investors, they have to meet at least 1 of the following 3 criteria:

- Income in the preceding 12 months is not less than SGD300,000 (or its equivalent in a foreign currency)

- Net personal assets exceeding SGD2 million (or its equivalent in a foreign currency) in value, of which the net value of the investor’s primary place of residence can only contribute up to SGD1 million

- Net Financial Assets exceeding SGD1 million (or its equivalent in a foreign currency) in value

If this criterion is satisfied, then such a person can be considered as an Accredited Investor.

Q What are the applicable requirements?

A

- Minimum Base Capital

Every LFMC (AI) is required to have a minimum base capital of 250,000 SGD. Please note, minimum base capital does not refer to the share capital of the legal entity. This is the amount you should always have in your accounts as a solvent company.

So generally, it is recommended to have enough buffer in the capital. LFMC is always required to assess the capital buffer and take necessary steps to bring it in line with a legal requirement.

- Risk Based Capital

LFMC is subject to Risk-based Capital maintenance requirements. Every LFMC (Whether A/ I or retail) is required to maintain risk based capital of 120% of its calculated risk.

- Office Requirement

LFMC should be a Singapore incorporated company and have a permanent physical office in Singapore. The office should be dedicated, secure and accessible only to the FMC’s directors and staff. A unit is serviced office is acceptable however, co-working spaces do not qualify as an office for FMC as it is not considered dedicated and accessible only to the staff.

If located in a serviced office, then your office must be an independent unit accessible to your staff only. Similarly, you are also required to take proper care and caution for safeguarding your IT equipment, which may be located outside your premises but in the data center.

- AML / CFT Requirements

An LFMC (AI) shall comply with the requirements on antimony laundering and countering the financing of terrorism [“AML/CFT”] requirements, as set out in the Notice to Capital Markets Service Licensees and Exempt Persons on Prevention of Money Laundering and Countering the Financing of Terrorism [SFA04-N02].

- Reporting of Misconduct

All LFMCs shall comply with the misconduct reporting requirements set out in the Notice on Reporting of Misconduct of Representatives by Holders of CMS License and Exempt Financial institutions [SFA04-N11].

- Compliance Function

A/I LFMC are not mandated to have their own independent compliance department if the AUM is less than 1 Billion Dollars. An LFMC (with assets under management lower than 1 billion dollars) can outsource its compliance function. However, it should ensure that it has adequate compliance arrangements commensurate with the scale, nature and complexity of its operations.

This may take the form of an independent compliance function, compliance support from overseas affiliates and/or use of external service providers that meet the requirements set out previously.

- Audit and Internal Audit

LFMC are subject to an annual audit and also internal audit.

- Risk Management Framework

An LFMC (A/I) shall put in place a risk management framework to identify, address and monitor the risks associated with customer assets that it manages, as required by regulation 13B(1)(a) of the SF(LCB)R. The LFMC should take into account the principles set out in the MAS Guidelines on Risk Management Practices that are applicable to all financial institutions and any other industry best practices that might be relevant. An LFMC should also be cognizant that these risks are dependent on the nature and size of its operations and the nature of assets that it manages.

- Professional Indemnity Insurance (PII)

It is not mandatory for LFMC (AI) to have any PII though MAS encourages taking one. So you need to consider your specific situation and decide accordingly. For LFMC (Retail) the PII is necessary.

- License fees to be paid to MAS

4000 SGD at the time of registration.

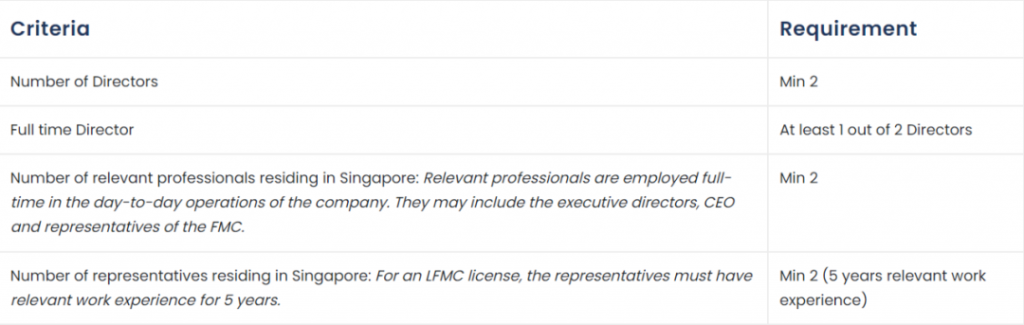

- Staffing Requirements

An LFMC is required to appoint an adequate number of directors, relevant professionals and representatives as set out in the table below. It must also appoint a Chief Executive Officer [“CEO”].

There is no restriction on the CEO to take on multiple appointments within the firm if there are synergies, e.g. the CEO can also be appointed as Executive Director, relevant professional and representative. The individual would then need to meet the requirements in respect of each appointment.

Q What is the processing time required?

A The expected processing time is 4 months to review and process an application if the business model is straightforward, the applicant meets the relevant admission criteria fully, and the application is complete and clear. For more complex cases, or cases where information is assessed to be incomplete or inaccurate, MAS will need a longer time to review the application.

It is therefore important that you use a professional firm like ours to process your application with MAS. Please ensure that your company’s application is complete, correct and accompanied by the requisite supporting documents.

Q Annual Compliance you will be subjected to?

A

Every LFMC (A/I), within 5 months after the accounting year, is required to file;

Statement of Assets and Liabilities

Statement of Financial Resources, Total Risk Requirement and Aggregate Indebtedness

Statement relating to the Accounts of a Holder of a CMS License

Statement relating to the Accounts of a Holder of a CMS License – Supplementary Information

Auditor’s Report – For a Holder of a CMS License

Auditor’s Certification – For a Holder of a CMS License

Audited financial statements (balance sheet and profit and loss statement) for the latest completed financial year

Every LFMC is also required to file with MAS, following two on a quarterly basis.