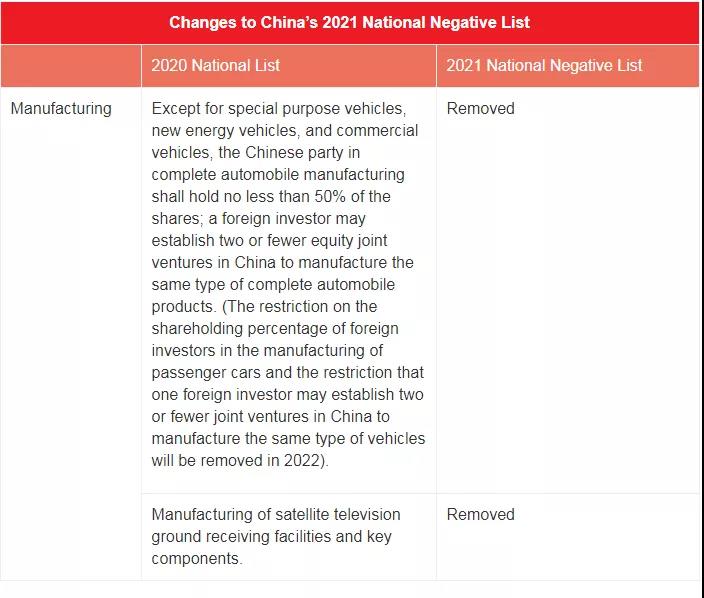

Negative List for Market Access to Be Further Shortened

Negative List

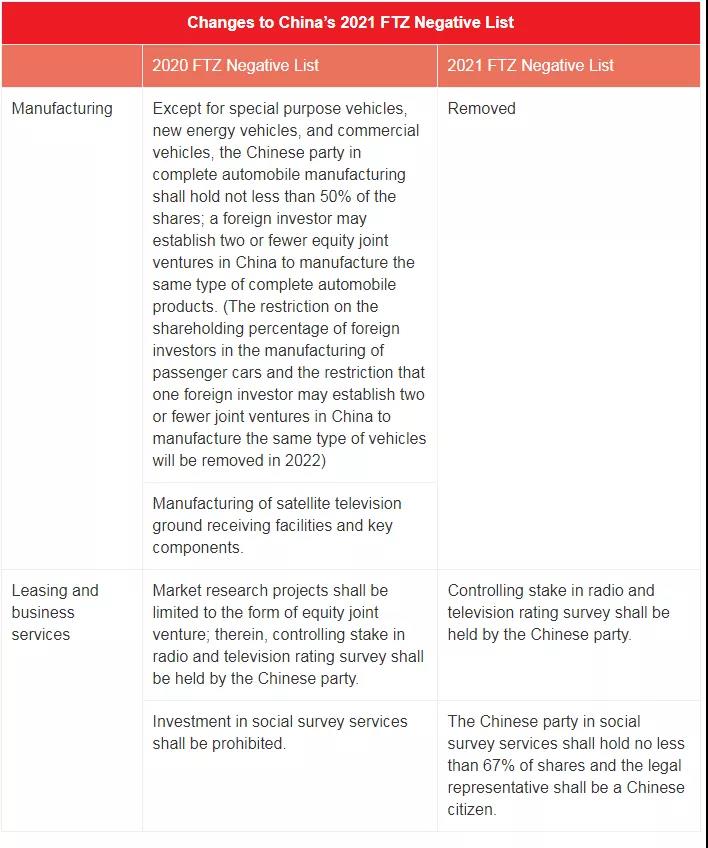

In addition, there will be no restrictions on foreign investment in the manufacturing sectors in Pilot Free Trade Zones.

Foreign investors are also not permitted to participate in the operation and management of these enterprises, and their shareholding ratio must be governed in accordance with the relevant regulations on the management of foreign investment in domestic securities.

China’s securities regulators and relevant authorities will implement precise management of overseas listing and financing of these domestic enterprises.

The notes add that foreign-invested enterprises must comply with the relevant provisions of the Negative Lists for investing in China, in accordance with the Regulations for the Implementation of the Foreign Investment Law.

In order to properly link the Negative Lists and the Negative List for Market Access, the explanatory notes added that “Foreign and domestic investors must uniformly apply the relevant provisions of the Negative List for Market Access”.

FTZ Negative List can be found below.

As to the implementation of the two Negative Lists, the NDRC said if the current laws or regulations need to be adjusted, the relevant departments will do so within two years. That is to say, all the new opening measures are expected to be implemented by the end of 2024 at the latest.