沙特公司注册与税务全解:出海中东的黄金窗口期

#沙特阿拉伯,作为全球最重要的“石油王国”,正站在经济变革的风口浪尖。依托《沙特2030愿景》,这个传统能源巨头正在加速推进经济多元化转型,向制造业、旅游、医疗、科技等领域全面开放。

对于中国企业而言,当前正是抢滩沙特市场、布局中东战略的绝佳时机。

PART/1

沙特公司注册 的四大核心优势

1 战略地理位置 ,链接亚非欧市场

沙特位于亚非欧三洲交汇处,辐射约旦、伊拉克、埃及等中东和北非国家,紧邻国际航运主通道,具备出色的物流中转优势,是拓展“一带一路”沿线市场的重要跳板。

2 100%外资持股,无需本地合作伙伴

沙特现已取消传统的合资强制条款,外国投资者可100%控股设立公司,无需本地股东,不仅提升决策效率,也让利润可以自由汇出,极大降低运营成本与合作风险。

3 “2030愿景”下的多元产业机会

政府持续推动非石油经济发展,鼓励外资在能源转型、工业制造、文化旅游、教育医疗、信息技术等多个领域投资,进口依赖度高,为中资企业提供广阔的出口和服务空间。

4 政策利好频出,营商环境大幅优化

统一投资注册平台,实现全流程电子化申报;

取消外商投资许可证(原MISA许可),外资与本地企业享同等待遇;

降低市场准入门槛, 多个高潜力行业全面向外资开放;

外汇自由进出,,主权基金活跃,政治稳定,营商信心持续增强。

PART/2 沙特公司注册类型与流程

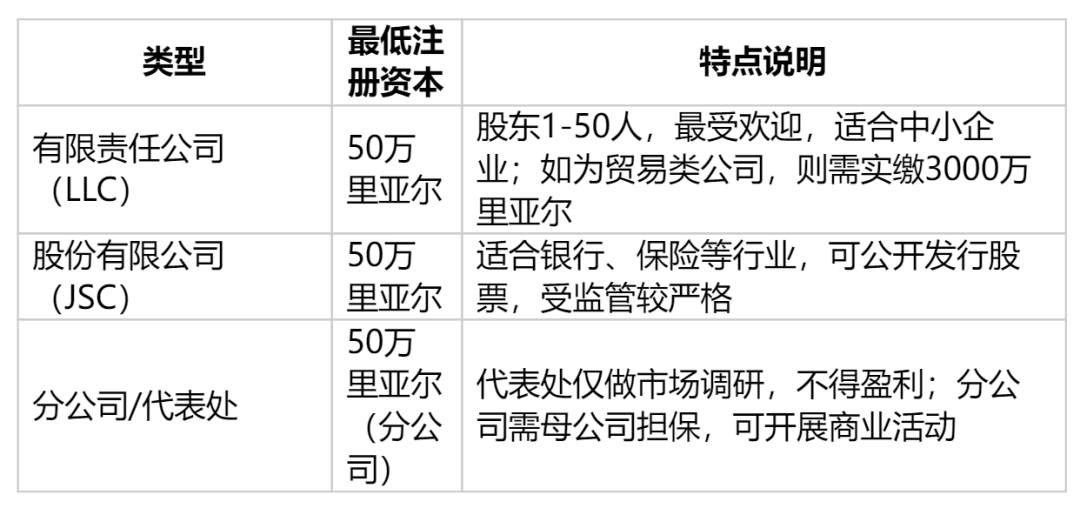

注册类型

注册流程:

1. 前期准备:公司命名(阿拉伯语)、确定经营范围、准备公证材料;

2. 投资许可证申请:向沙特投资部(MISA)申请,周期约2-4周;

3. 商业注册与开户: 商业登记(MCI)、开设银行账户、存入资本;

4. 后续合规

a. 税务(GAZT)、社保(GOSI)、商会注册;

b. 劳工事务:需满足“沙特化”就业比例。

PART/3 税务体系与优惠政策

主要税种:

● 企业所得税: 标准税率20%;区域总部型跨国公司可享高达30年免税(需满足经济实质条件);

● 增值税(VAT)标准 15% 年销售额超18.75万里亚尔强制注册;

● 其他:消费税(烟草、饮料等)、宗教税(2.5%,适用于GCC成员企业)、劳工税等。

税务优势:

● 最长5年免税期 初创阶段减轻税负;

● 特定行业税率优惠: 鼓励制造、清洁能源、高科技等领域;

● 税务合规建议:

合理规划进项、销项时间,利用VAT抵扣机制;

保留5年以上账目,避免未来追溯风险;

建议聘请本地税务顾问协助申报与沟通,减少语言与制度误差。

PART/4

抢占先机的战略建议

2025年,沙特推出的新外资注册政策,是其推动结构性经济改革的重要里程碑。对于正寻求全球布局的中国企业来说,这不仅是一次降低成本、提升效率的机会,更是全球化战略布局中的中东支点。

建议企业:

● 尽早制定沙特市场进入计划;

● 准备充足的注册材料(建议进行阿拉伯语翻译和公证);

● 借助专业机构力量,完成注册与税务合规;

● 深耕本地化,挖掘长期价值。

中东风口已起,沙特正当时。沙特2025年公司注册新政策的发布,是沙特深化经济改革、推动多元化发展的重要里程碑。

新政策为中国企业进入沙特市场提供了前所未有的便利和优势。既是一次降低成本、提升效率的契机,也是加速全球化布局、抢占中东及更广泛市场的战略机会。

别让政策红利悄然流失,开启沙特之门,让您的企业成为下一个中东市场的领跑者。

想了解更多注册细节或获取专属咨询?欢迎联系我们的专家团队,助您顺利进军中东市场。