At the beginning of June, Elitestage invited tax expert Eve Yu to share a speech on the personal income tax policy of foreign individuals.

Hereby, Elite Stage summarized the key contents for you.

Is there any difference regarding individual income tax for Green Card holers and non-Green Card holders ?

Resident individual VS Non-resident individual

Legally speaking, personal income tax payment responsibility has nothing to do with nationality or green card. Personal income tax is imposed on the criterionof residents or non-residents .Residents or non-residents is the only criterion to determine whether you’re a taxpayer or not in China.What’s more, the concept of residents and non-residents is determined by the concept of “residence”.

How to explain the concept of “residence”?

There are three key points as follows:Having Registered residence in China (basicallay for Chinese citizens)Family economic interest relationship existingHabitual residence in China

For foreigners who apply for a green card, the “family economic interests and habitual residence in China” may change in real time, here are some cases as references.Before applying for a green card, the foreigner A came to China alone for 3-year work dispatch.After he got his green card, he planned to bring his family to China and start a company in China. In that case it indeed meets the conditions of “there is a family interest relationship and is habitually living in China” and can be regarded as a tax-paying resident.But there is also a reverse case. The foreigner B came to Shanghai with his family but after applying for the green card, his child is going to college, and his wife plans to leave with the child. Then this kind of case does not meet the qualification of “residence”, and it may not be deemded as a “resident individual”.Finally, the teacher underlined the key points: the definition of whether the individual income tax should be paid , differs from person to person, and in most cases, individual case analysis is needed.

2. Global Taxation-Avoid Double Taxation ?

What’s the double taxation ?

Double taxation refers that two or more countries according to their own tax jurisdiction impose the same category tax on the same taxpayer of the same tax objects in the same tax period at the same time.

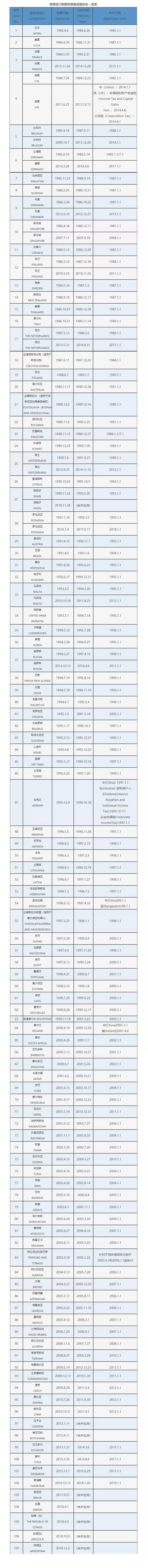

Which countries have signed agreements with China to avoid double taxation?

According to the latest information from the State Administration of Taxation, 102 countries have signed agreements on avoidance of double taxation. The specific list is as follows:

In fact, each country on double taxation implemantation is different. How to avoid double taxation is a very broad topic.If you have the needs about personal tax planning, feel free to contact us to make an appointment with our tax expert Eve Yu.